Technically, AUD remained neutral in a 0.7640-0.7700 tight range, the stronger USD offset by yesterday’s upside GDP surprise.

For more readings on our recent our technical write up, please visit the below weblink:

AUDUSD in medium term perspective: Predict to slide lower to 0.7400. The US dollar’s impressive post-election rally may have paused, but still has potential to rise further during the months ahead. The Fed’s assertive tightening bias plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar. Against that coal and iron ore are likely to sustain a good portion of their dramatic rises, and economic data for Q4 and Q1 should improve, but these forces are subservient to the US dollar’s trend. Australia’s AAA rating will remain an issue into the May budget.

The Fed’s assertive tightening bias plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar.

OTC updates & option strategy:

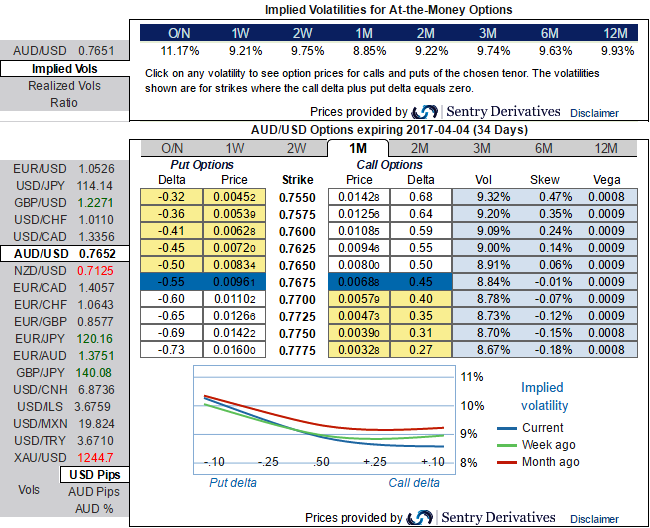

Initiate longs in 2m AUDUSD (0.5%) in the money -0.55 delta put; simultaneously, short 2m (1%) out of the money call at net debit.

Rationale: The nutshell showing risk reversals are bids for the hedging for the downside risks, as a result, puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

Let’s glance on sensitivity tool for 1-3m IV skews would signify the interests of OTM put strikes that means the ATM puts higher likelihood of expiring in-the-money, so writing overpriced OTM calls would be a smart move to reduce hedging cost.

AUDUSD's higher IVs with increasing negative delta risk reversal can be interpreted as the opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Fundamentally, Fed Chair Yellen upheld hawkish views in her recent speech, adding that the economy is approaching the Fed's dual mandate of inflation and employment. She further mentioned that the US is near full employment and with inflation figures stabilizing; there is a need for gradual Fed tightening, although she did not mention the exact timing of an interest rate hike.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise