Bearish scenarios: AUDUSD below 0.72 if:

1) The unemployment rate breaks above 6%, forcing the RBA to respond more aggressively to weak inflation;

2) The Fed responds to animal spirits and bullish survey data by delivering a faster pace of hikes than currently expected;

3) China data weaken materially, validating the fall in commodity prices.

Bullish scenarios: AUDUSD towards 0.78 if:

1) China eases policy and commodities rebound;

2) The Fed’s tightening timeline is severely disrupted by a weakening in local data; or

3) The Australian housing market reaccelerates

OTC indications and options strategy:

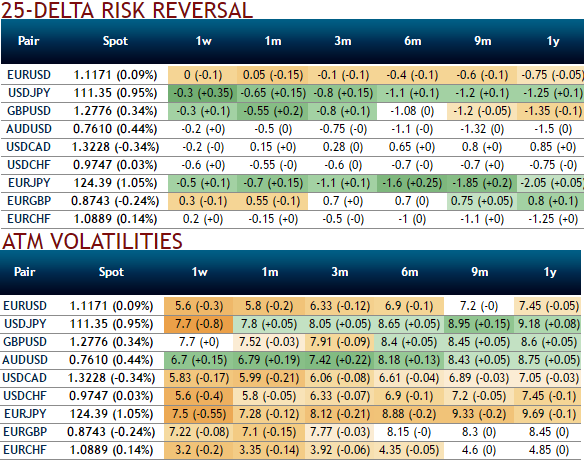

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM strikes upto 0.7350 (refer above diagram)

While delta risk reversal reveals divulge more interests in hedging activities for downside risks even though we see the positive shift in hedging arrangements. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.74-75 or below technical levels. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 1-3m risks reversals that would encompass Fed’s June meeting.

AUDUSD's higher IV with negative delta risk reversal can be interpreted as the opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Hence, we advocate weighing up above aspects in below option strategy, we eye on loading up with fresh vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of vega long in 1m ATM -0.49 delta put options and 1 lot of (1%) ITM -0.55 delta put of 2m expiry.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data