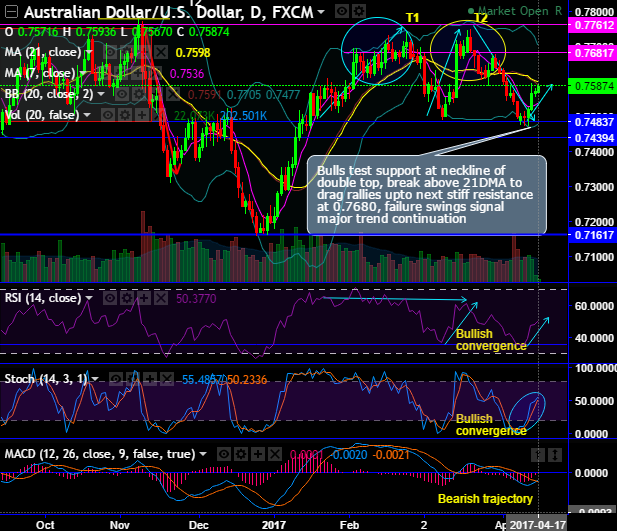

On daily charts, the pair forms top 1 at 0.7740 and top 2 at 0.7749 levels with the neckline at 0.7481 levels.

Bulls test support at the neckline of the double top (refer daily chart, break above 21DMA to drag rallies upto next stiff resistance at 0.7680, failure swings signal major trend continuation.

As you could see, the major trend has been sliding below through sloping channel, but on the contrary, the consolidation phase that has begun from October 2015 still seems robust. Current prices are sensing resistance at 0.7761 levels, hovering around channel resistance (see this month’s candle), any breach above channel resistance to boost up this consolidation phase.

Ever since the bears have managed to reject the previous upswings at stiff resistance at 0.7761 levels, the current prices are still below 7EMA, considerably, huge volumes are in conformity with the weakness in this pair.

As prices dropped at 0.7761 levels, the triple top formation seems to be likely on weekly timeframe with top 1 at 0.7835, top 2 at 0.7778 and top 3 at 0.7749 levels.

Moreover, spinning top pattern has occurred in monthly terms to evidence more slumps but the major trend is stuck in the range of 0.7761 and 0.7210 levels, the current prices are attempting to break below 7EMAs.

The prevailing weakness shrinks the momentum in the previous consolidation phase that’s been prolonging October 2015.

Most importantly, both leading oscillators on both time frames are slightly indecisive and signaling overbought pressures.

FX derivatives strategic recommendation:

Well, amid prevailing bullish sentiment on hedging grounds, we advocate shorting futures contract of near-month expiries to arrest downside risks towards 0.7500, 0.7421 or even 0.7306 levels cannot be ruled out upon breach of 1st two targets.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.