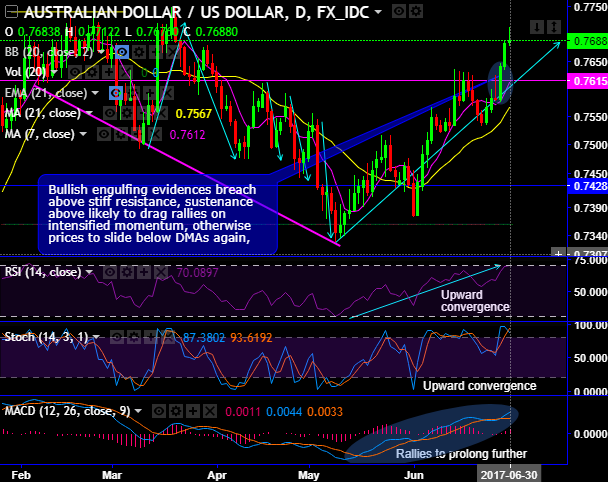

AUDUSD keeps spiking, now on the verge of 4-months highs after breaching strong resistance, major trend still range bounded. Ever since AUDUSD bulls have bottomed out at 0.7328, the prices have constantly remained above 7 & 21DMAs but for today, both leading and lagging oscillators’ have been bullish bias (refer daily charts). The current price is now all set to hit 4-months highs.

On daily terms, bullish engulfing pattern candle evidences the breach above stiff resistance of 0.7615 and 0.7633 marks, sustenance above likely to drag rallies on intensified momentum, otherwise prices to slide below DMAs again.

Current prices are edging towards range resistance of around 0.78 levels (hardly 110 pips away from the current spot levels).

But that’s where shooting star patterns have occurred several times and evidenced slumps. As a result, the major trend now stuck in range, but the current prices now are attempting to break out range topline.

In the recent past, shooting star pattern candle pattern has already been popped up the same levels to signal the weakness at this peak.

On the contrary, despite this stiff tug of war in last three months, bulls have managed to pull back prices above EMAs so as to ensure the major trend to prolong in range.

The major trend has now been in consolidation phase that seems to be drifting in tight range; any attempts of failure swings at this level (at 21EMA) likely to resume major downtrend (refer monthly charts).

Both momentum indicators (on monthly terms) have been indecisive but strength is shrunk away in the previous uptrend at 57 RSI levels, whereas intraday trend has been indecisive but slightly in bulls’ favour.

The prevailing upswings are not favoured by healthy bullish momentum both RSI and stochastic curves at this juncture. MACD on this timeframe signals bullish swings to prolong further.

At spot reference: 0.7690 the intraday speculators can eye on targets between 0.7750 which means another 40-50 pips. Hence, we would wish to use one touch binary call options at every dips. This leveraged instrument can have an ability to give in magnifying effects to its payoff on every underlying price spikes.

Currency Strength Index: FxWirePro's hourly AUD spot index is struggling at 6 levels (which is neutral), while hourly USD spot index was at shy above -50 (bearish) at 06:44 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: