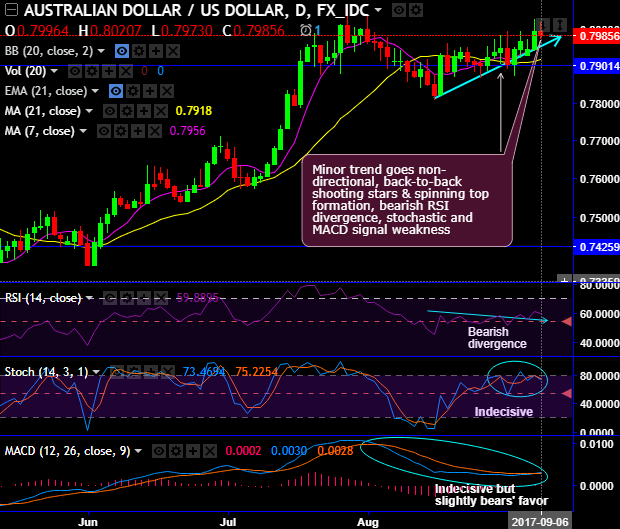

AUDUSD has seemingly moved in non-directional trend after brief downtrend in the recent past. Consequently, bears have managed to show their effects by forming shooting star and spinning top patterns on daily terms (refer rectangular area on daily chart). The strong support is tested at 0.7875 levels.

For now, we foresee more slumps as it attempts to break below major support at 0.7956 (7DMA levels).

But on broader perspectives, the major trend has now been in consolidation phase breaking above range, as the current prices are spiking above EMAs, we get the skepticism on further rallies (refer monthly charts) as the major trend is bearish biased.

Momentum indicators (on the daily chart) have been evidencing bearish divergence that signals the losing strength in the previous bullish sentiments. But on monthly terms, it is signaling strength and no momentum in the consolidation phase.

For the month, upswings are not favored by healthy bullish momentum. Both RSI and stochastic curves have been slightly indecisive at this juncture.

MACD on daily time frame signals bearish swings to prolong further.

Hence, at spot reference: 0.7982 the intraday speculators can eye on southward targets upto 0.7870 levels, which means further downward travel of another 100-110 pips as we don’t see any dramatic buying interest for now.

Contemplating above technical rationale, on trading perspective, it is advisable to buy one touch binary put options, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps sliding on or before the binary expiry duration.

Currency Strength Index: FxWirePro's hourly AUD spot index has shown 42 (which is bullish), while hourly USD spot index was at -150 (highly bearish) at 06:46 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: