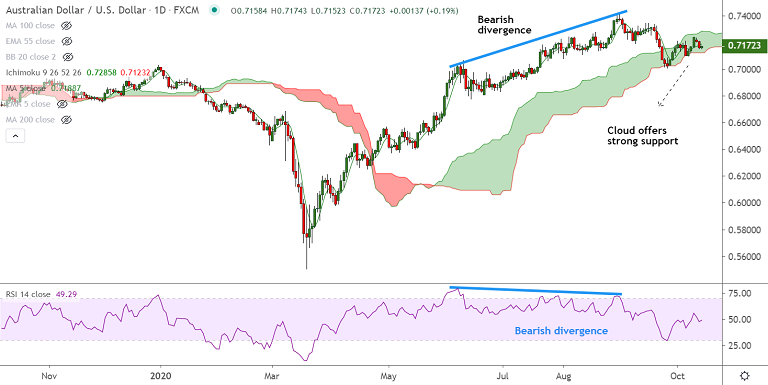

AUD/USD chart - Trading View

AUD/USD was trading 0.20% higher on the day at 0.7173 at around 04:25 GMT, after closing 0.67% lower in the previous session.

Better-than-expected Australia's Consumer Confidence data and a rebound in S&P 500 futures offer support to the higher-yielding Aussie.

Data released earlier today showed Australia's Consumer Confidence printed at 11.9% in October from September's 18%, but bettering the estimate of 9.9%.

That said, China's ban Australian Coal imports, raising concerns about rising political tensions likely to keep upside limited.

Further, the PBoC said it will be monitoring the Yuan’s performance which suggests the AUD could be vulnerable to a deeper correction.

Major and minor trend in the pair have turned neutral, but price action holds above 200-DMA.

We are seeing some weakness on account of a 'Bearish Divergence' on the daily charts. Break below cloud will drag prices lower.

On the flipside, decisive breakout above 200W MA will fuel further gains in the pair. Next major bull target lies at 78.6% Fib at 0.7573.

Support levels - 0.7152 (55-EMA), 0.7123 (Cloud base), 0.71

Resistance levels - 0.7242 (200W MA), 0.7305 (Upper BB), 0.7573 (78.6% Fib)