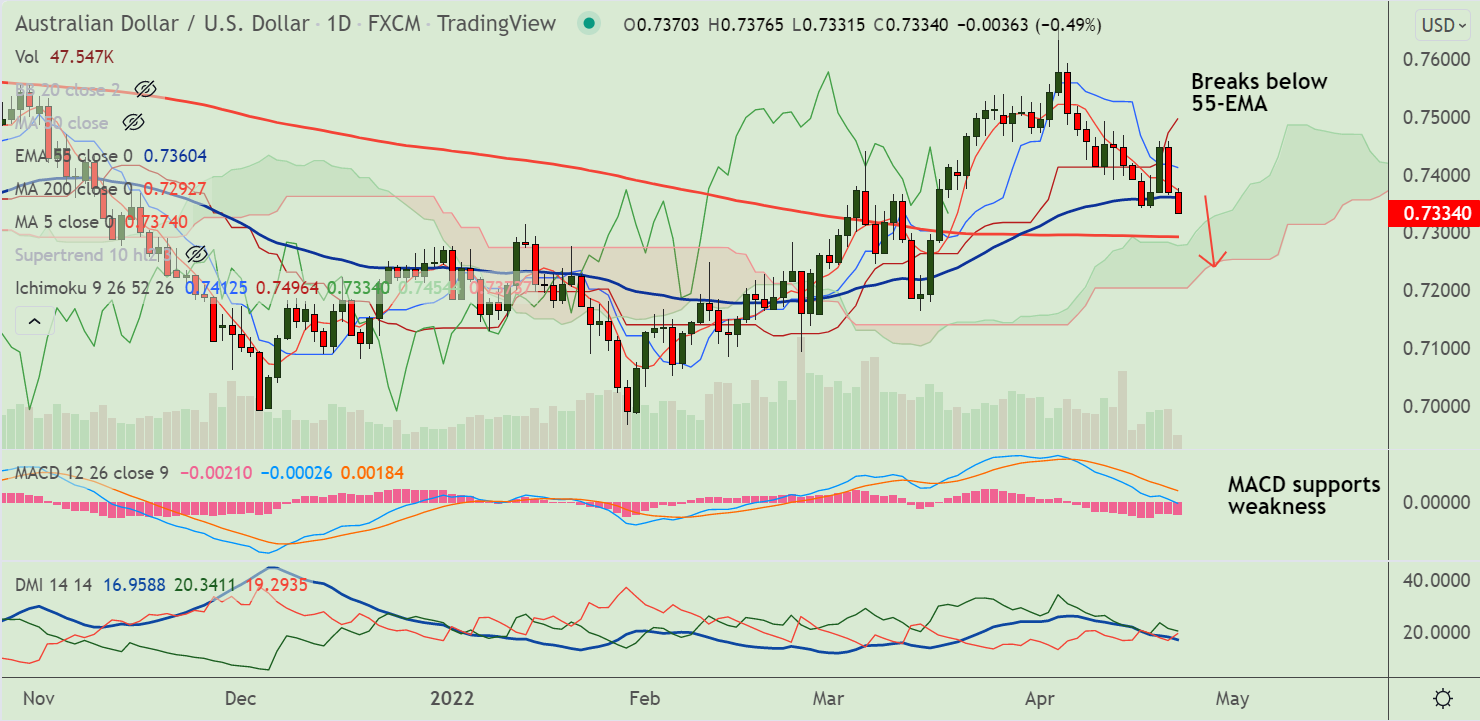

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- AUD/USD was trading 0.43% lower on the day at 0.7338 at around 05:55 GMT

- The pair is extending previous session's slump, hits fresh monthly lows

- Price action has formed a 'Bearish Engulfing' pattern on the previous day's candle

- The major has broken below 55-EMA and is on track to test 110-EMA support

- Momentum is bearish and volatility is high, price action has slipped below 200H MA

- GMMA indicator shows major trend is neutral, while minor trend has turned bearish

Support levels:

S1: 0.7323 (110-EMA)

S2: 0.7292 (200-DMA)

Resistance levels:

R1: 0.7360 (55-EMA)

R2: 0.7374 (5-DMA)

Summary: US dollar buoyed on hawkish Fed rhetoric, dragging the pair lower. Break below 110-EMA will see test of 200-DMA AT 0.7292.