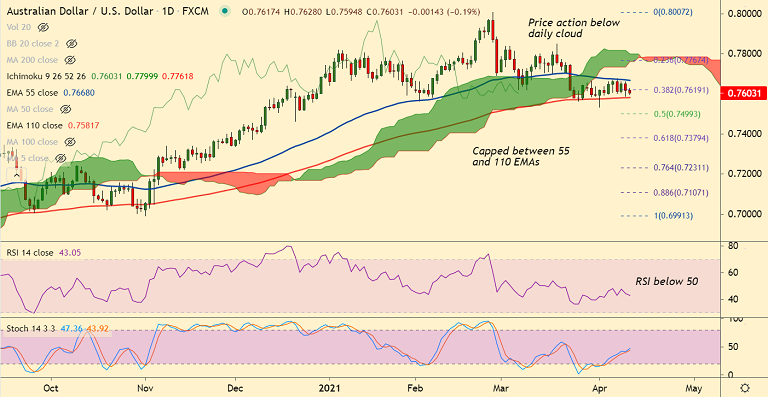

AUD/USD chart - Trading View

AUD/USD is extending weakness for the 2nd straight session, bias has turned bearish.

The pair is under downside pressure amid downbeat market mood and strong U.S. dollar.

Price action has been rejected at stiff resistance at 21-EMA and minor recovery attempts are capped below 5-DMA.

RSI is below 50 and biased lower, price action is below daily cloud and Chikou span is biased lower.

Focus now on the March US Consumer Price Index scheduled this Tuesday, with headline expected at 2.5% YoY vs. 1.7% in February and core expected at 1.6% YoY vs. 1.3% in February.

Support levels - 0.7591 (21W EMA), 0.7581 (110-EMA), 0.7522 (Lower BB)

Resistance levels - 0.7628 (5-DMA), 0.7651 (21-EMA), 0.7667 (55-EMA)

Summary: AUD/USD price action is continuing grind sideways between 55 and 110 EMA, breach breakout will provide clear directional bias.