- Aussie rally on stronger commodity prices and improved business confidence data stalls at 0.7658 levels.

- The pair has slipped from highs and is currently struggling at the 0.76 handle.

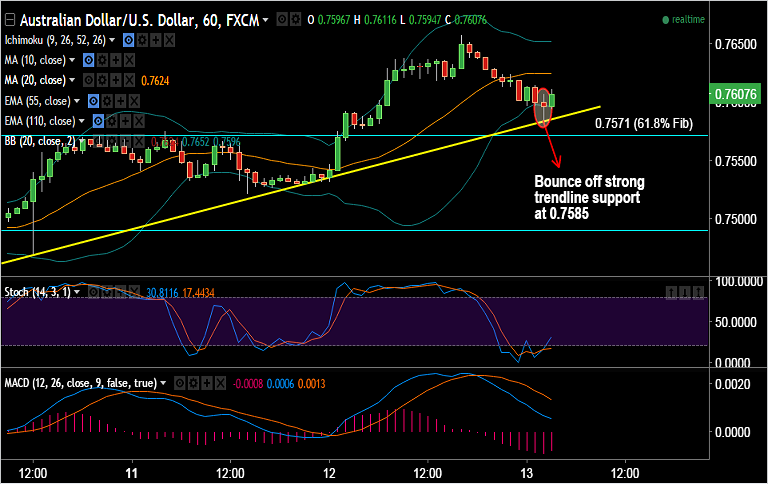

- We see strong trendline support at 0.7585 levels, further weakness only on break below.

- Downside could then test 0.7571 (61.8% Fib), further weakness could take the pair to 0.7530 (July 12 lows).

- On the upside, resistance is aligned at 0.7658 (July 12 high), 0.7687 (78.6% Fib) and then 0.77 levels.

- Our previous call (http://www.econotimes.com/FxWirePro-AUD-USD-capped-at-618-Fib-good-to-long-breakout-above-233842) has achieved TP1&2.

- Australia Westpac Consumer Confidence Index down to 99.1 in July from previous 102.2.

- China data awaited, a 5% decline in exports and 6.2% decline in imports expected. Sliding Chinese exports could weigh over the Aussie dollar and iron ore prices.

Trade Idea: Good to go short on break below 0.7585, SL: 0.7630, TP: 0.7530/ 0.75