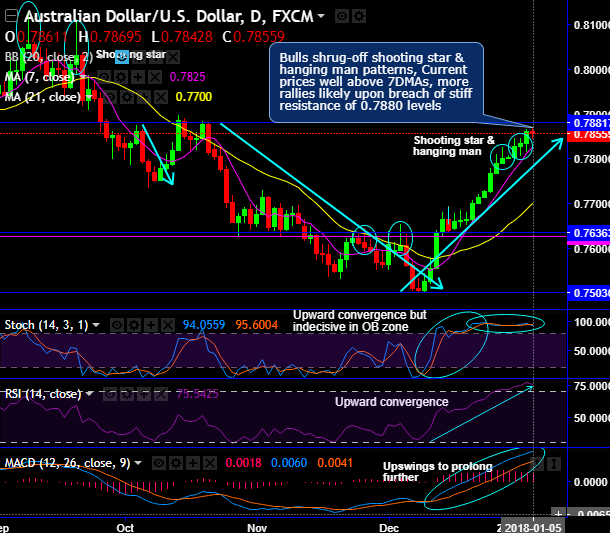

Shooting star & hanging man patterns have occurred at 0.7801 and 0.7834 levels. Bulls shrug-off these bearish patterns, the current prices well above 7DMAs, but previous rallies seem to be little edgy at a stiff resistance of 0.7880 levels (refer daily chart).

More rallies seem to be likely only upon breach of these resistance levels.

On a broader perspective, the pair has been going through consolidation phase after a massive downtrend. While shooting star evidences considerable slumps from last September, the bullish engulfing pattern has occurred at 0.7801 levels to counter dips, bulls manage to break-out channel & range resistance again, the major trend goes non-directional (refer monthly plotting).

Although both leading oscillators (RSI & Stochastic) have constantly been showing upward convergence, momentum seems to be little edgy in overbought territory for now on daily terms.

While both lagging indicators (7 & 21 DMAs, EMAs & MACD) signal extension of bull swings.

Trade tips: Well, on trading perspective, at spot reference: 0.7853, it is advisable to buy boundary binaries using upper strikes at 0.7881 and lower strikes at 0.7824 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains within these strikes on or before the binary expiry duration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 0.68 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 99 levels (which is bullish), while hourly USD spot index was at -68 (bearish) while articulating (at 05:45 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: