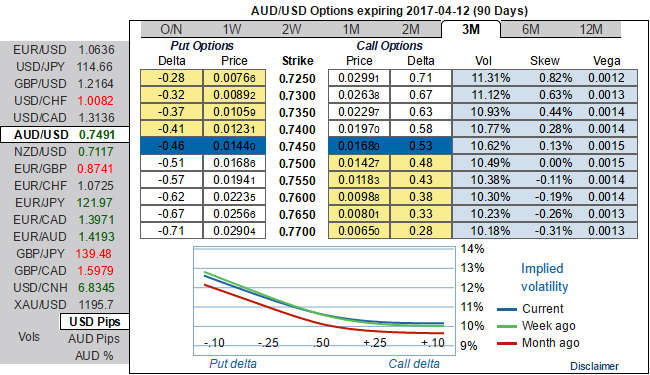

Please be noted that even though the risks reversals have shown the shift in hedging sentiments, the IV skews in far month contracts of this APAC pair has been evidencing downside risks still remain intact as OTM puts are the bids on high demand, IVs flashing above 10.5% for 3m expiry for 3m tenors.

While delta risk reversal reveals divulge more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.7518 technical levels where we see stiff resistances. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 3m risks reversals.

AUDUSD's higher IV with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Hence, as shown in the diagram, contemplating the above risk reversal computations, we construct strategy comprising of both calls as well as puts in the ratio of 2:1 so as to suit the swings on either direction.

In a major downtrend of this pair, capitalizing on reducing IVs we eye on shorting out of the money calls with shorter expiries which would lock in certain yields by initial receipts of premiums and risk reversals to favor longs in puts in lengthier tenors.

Well, here goes the strategy, go short in 1m (1%) OTM calls and simultaneously, 2 lots of 3m puts (+1% ITM, and ATM strikes) are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays