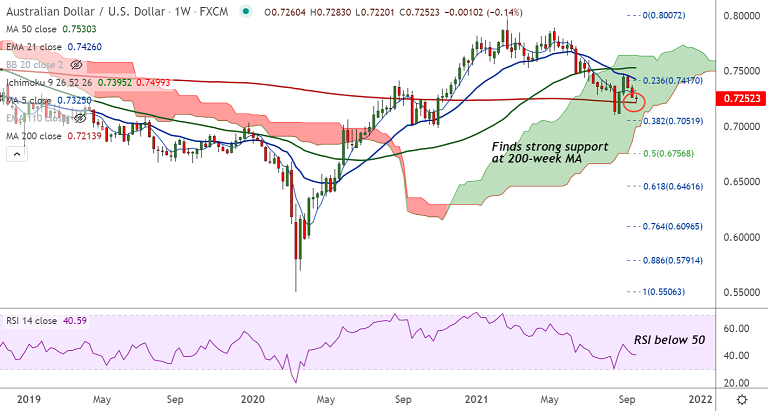

AUD/USD chart - Trading View

AUD/USD was trading 0.29% higher on the day at 0.7250 at around 03:00 GMT, snapping a four-day downtrend.

PBOC event and positive expectations that Evergrande's main unit will make local payment on Thursday boosted risk-on across markets, supporting the pair higher.

Bank of China (PBOC) left the benchmark cash rate unchanged near 3.85%, and adhered to the heavy cash injection of around 110 billion Chinese yuan.

Earlier in the day, the International Monetary Fund’s (IMF) Chief Economist Gita Gopinath also sounded optimistic over China’s ability to tame the fears emanating from the real-estate firm.

PBOC's heavy cash injection hints at the dragon nation’s ability to avoid a liquidity crunch should Evergrande default.

Risk sentiment buoyed as Evergrande hints at paying the coupon on onshore bonds at the September 23 expiry.

AUD/USD trades with a bearish bias. Momentum studies point to downside and volatility is high.

Markets await for the Fed for fresh impulse. Investors remain cautious ahead of the Fed event.

Price action finds major support at 200-week MA at 0.7213. Break below will plummet prices. Next major bear target lies at 38.2% Fib at 0.7051.