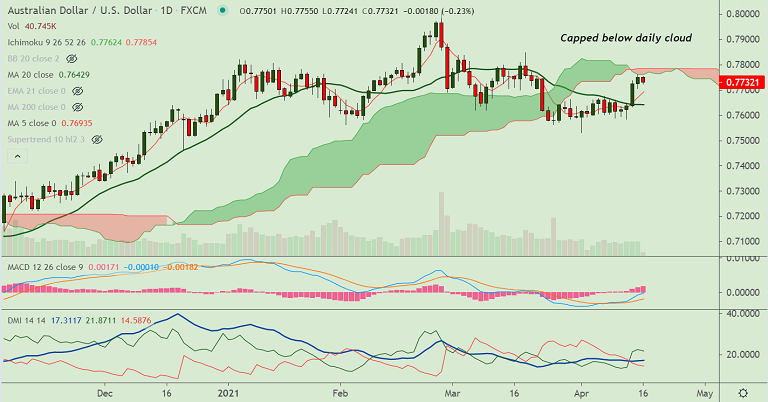

AUD/USD chart - Trading View

AUD/USD was trading 0.19% lower on the day at 0.7735 at around 04:35 GMT.

The Australian dollar under pressure on downbeat China GDP, Industrial Production data.

China flashed mixed data on early Friday. China Q1 GDP, Industrial Production came in weaker-than-expected but Retail Sales crosses forecast and prior.

China’s Q1 GDP fell to 0.6% YoY, missing forecasts at 1.5% and 2.6% prior, while Industrial Production weakened to 14.1% versus 17.2% expected and 35.1% previous.

However, Retail Sales improved to 34.2% beating 28.0% market consensus and 33.8% during the previous month.

AUD/USD has paused upside after 4 straight sessions of gains. Daily cloud is seen as stiff resistance.

However, technical bias is bullish for the pair. Bullish momentum and 5-DMA crossover on 20-DMA add to upside bias.

Break above daily cloud will buoy bulls in the pair. Next immediate hurdle lies at 0.7858 (Upper W BB).

On the flipside, 5-DMA is immediate support at 0.7693. Break below will see some weakness. Bullish invalidation only below 21W EMA.