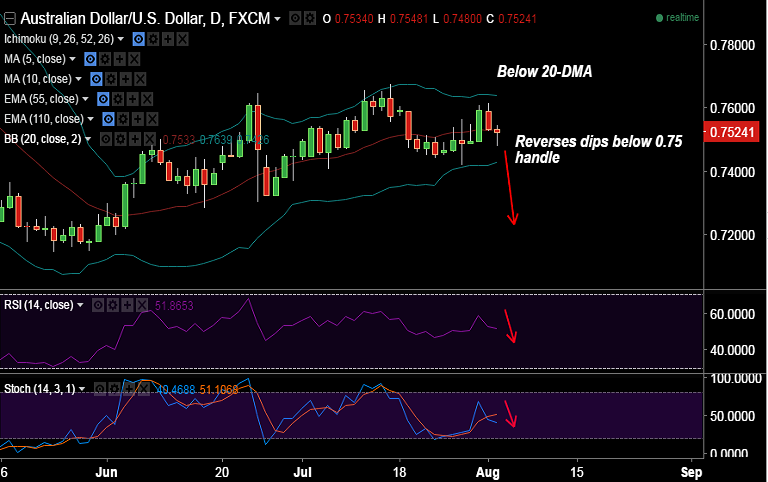

- AUD/USD see knee-jerk dips below 0.75 handle to hit lows of 0.7480 after the RBA cut rates by 25 bps as expected.

- The cut was largely priced in wake of dwindling economic growth, mixed labour market and rising AUD.

- The pair has quickly reversed the dip to trade around 0.7520 levels, finds stiff resistance at 1H 20-SMA at 0.7550.

- Intraday bias is lower, we see scope for test of 0.7455 and then 0.7420 levels.

Recommendation: Good to sell rallies around 0.7520/30, SL: 0.76/ TP: 0.7480/ 0.7440/ 0.7420