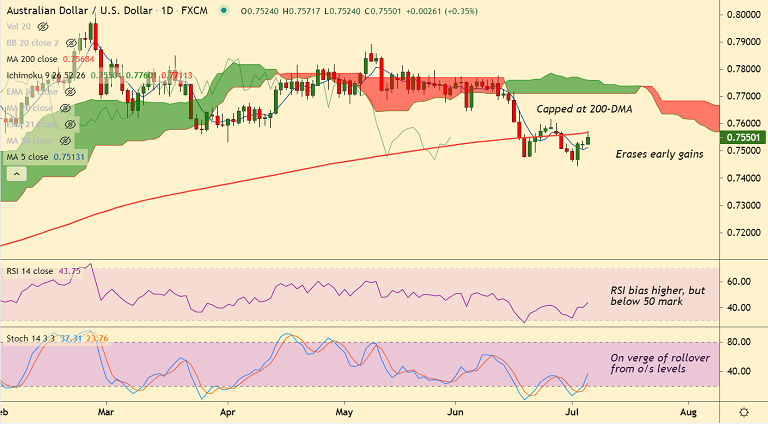

AUD/USD chart - Trading View

Spot Analysis: AUD/USD was trading 0.52% higher on the day at 0.7563 at around 05:00 GMT

Previous Week's High/ Low: 0.7601/ 0.7444

Previous Session's High/ Low: 0.7537/ 0.7508

Fundamental Overview:

The Reserve Bank of Australia (RBA) left the benchmark interest rate unchanged at 0.10% while also keeping the three-year bond yield target steady.

AUD/USD eased back to 0.7543 post RBA decision. Interbank futures imply some risk of a rate hike by late next year.

Aussie bulls resume upside after initial slump as investors turn focus onto comments from RBA Governor Lowe to know the reason behind the latest moves.

Focus also on the US ISM Service Purchase Manager Index (PMI) and FOMC Minutes of Meeting on Wednesday for fresh trading impetus.

Technical Analysis:

- AUD/USD slipped lower to hit 0.7543 before resuming upside

- Price action hovers around 200-DMA resistance at 0.7568

- Technical bias for the pair is bullish on the intraday charts

- RSI is biased higher and MACD is on verge of bullish crossover on signal line

- Price action is now above 200H MA and breakout above 200-DMA will fuel further gains

Summary: Price action is pivotal at 200-DMA resistance, decisive break above will fuel further gains. Next major hurdle lies at 0.7582 ahead of 0.7641.