Today, Aussie dollar gains considerably as the Reserve Bank of Australia makes constructive comments and on the disappointing U.S. data continued to weigh broadly on the greenback (retail sales and UoM consumer sentiments have missed the estimates).

The Australian dollar has performed very well since the start of the year but is now toppish. Though the AUD and NZD need fresh catalysts to establish new trends or revive the bearish trend, they have priced in a lot of (relatively) better Chinese news, whereas the technical picture suggests that a reversal could be imminent. AUDUSD is testing a multi-year downtrend line below 0.78 and will face horizontal resistance at 0.7850.

In terms of near-term valuation, AUDUSD is outperforming both iron ore, one of its key drivers, and, even more massively, the short-term interest rate differential. The AUD is being supported by the low volatility environment favouring the carry trade.

The RBA cut rates as expected in the recent monetary policy meeting, and one more cut this year remains a possibility (priced at 50% by year-end). However, the currency subsequently appreciated despite AUD rates reaching an all-time low (2y swap rate below 1.85%), making it vulnerable to the next blip in risk conditions.

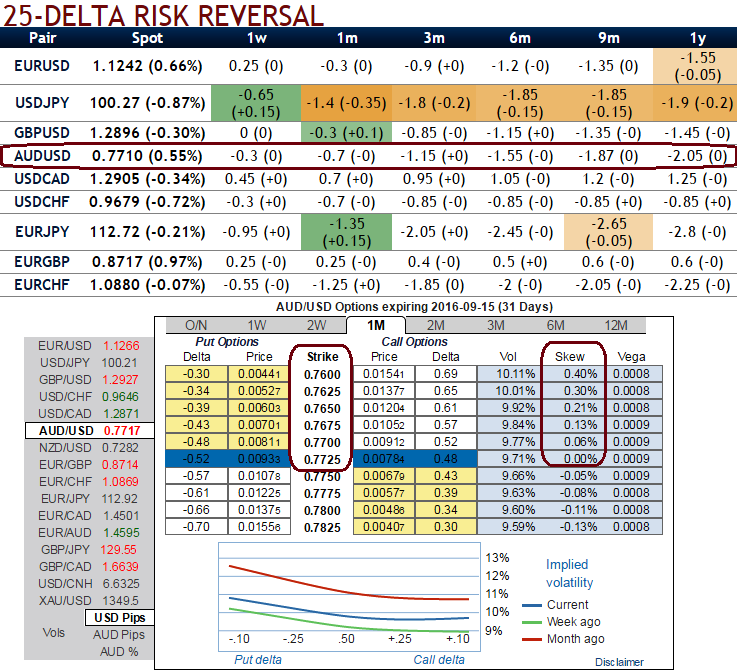

Short-dated AUD skew historically cheap, hence, we reckon AUDUSD upside in medium-longer run is to be limited; as we think the risk to AUD is still skewed towards downside in OTC as well (1m ATM IVs skews and RR are the live evidences for this).

The timing is attractive to buy short-dated AUD puts tactically, with the downside skew currently ultra cheap. The AUDUSD 1m risk reversal is trading at -0.7, the lowest level since 2009.

But, with a low volatility and skew configuration, buying a put spread-like structure is not attractive to trade downside tactically for fresh hedgers, since selling the low strike will not generate enough leverage, already holding positions via spreads with longer tenors is fine with hedging portfolios.

On the other hand, selling topside is risky, since a break of the technical levels mentioned above (invalidating our view) would trigger a bullish acceleration.

The best implementation is therefore to buy an OTM short-dated put, which seems to be conducive that limits the premium and offers convexity and the appropriate vega exposure on the downside.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings