AUDUSD short term & medium term perspectives: in near term, bears lingering for it to breach below 0.7673 where a strong support is observed, RBA maintained status quo in its cash rate which is widely anticipated to be firmly on hold.

If the Aussie central bank continues to maintain the same monetary policy stance, the US dollar likely to rise on tighter Fed policy, then AUDUSD could drop to 0.75 by year-end.

We reckon the USD rebound appears to be prolonging amid the upbeat US CPI and the speculative Fed rate-hiking expectations have remained largely unchanged. A rate hike in December is still only priced in at only two thirds to give US yields an additional boost.

Hedge using Reverse Put Spreads

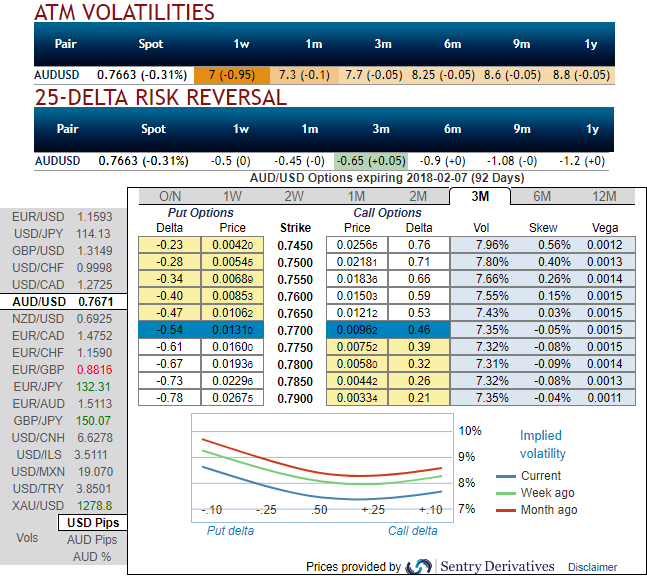

OTC outlook: Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.7450 levels (refer above diagram). While bearish neutral delta risk reversal divulges the interests in hedging activities for downside risks remains intact amid mild upswings.

Please also note that 1m IVs shrinking away, while ATM puts of these tenors are overpriced at 20% above NPV, while IVs of 1m expiries are just shy above 7.3%. Hence, it is deemed to be perceived as the disparity between options pricing and IVs.

As a result, the bearish stance has been substantiated by AUDUSD's rising IV in 1-3m which is an opportunity for put longs in long-term and using shrinking IVs of shorter tenors could be interpreted as an opportunity for writing OTM puts or theta shorts in short run on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

So, the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price dips and bidding theta shorts in short run and 3m risks reversals to optimally utilize Vega longs.

We advocate weighing up above aspects and uphold the same option strategy on hedging grounds, we eye on loading up with fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch