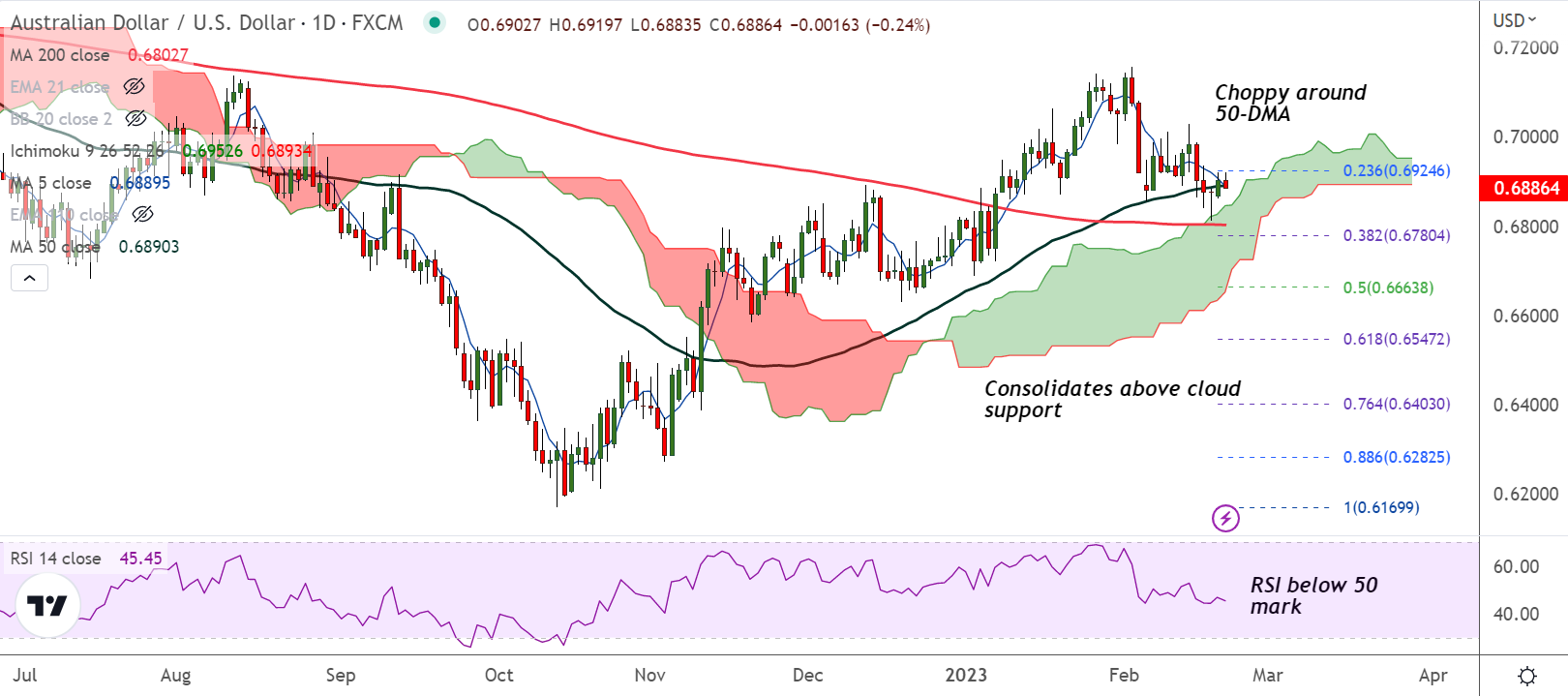

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.24% lower on the day at 0.6885 at around 07:15 GMT.

Previous Week's High/ Low: 0.7029/ 0.6811

Previous Session's High/ Low: 0.6920/ 0.6862

Fundamental Overview:

Minutes of the Feb. 7 policy meeting out on Tuesday showed the Reserve Bank of Australia's (RBA) Board only discussed two options - hiking by 50 basis points or 25 bps. That was a marked change from December when it had considered staying pat.

Reserve Bank of Australia's (RBA) Feb. 7 policy meeting minutes out on Tuesday showed the Board had also considered raising interest rates by 50 basis points, as it struggled to bring down inflation from overheated levels.

The RBA had eventually settled on a 25 basis point (bps) hike, raising rates to 3.35 bps. The central bank had hiked rates by a cumulative 300 basis points in 2022 .

The minutes showed that members saw uncertainty around the near-term economic outlook and that regular meetings gave the bank enough scope to keep raising rates.

Focus now on Australia Wage Price Index data due on Wednesday to gauge how much higher rates would have to go. Wage growth seen picking up to a fresh eight-year high of 3.5% in Q4 last year.

Risk catalysts will also influence price action ahead of the first readings for the US February PMIs. A firmer reading will support the US dollar.

Later in the week, investors will be focused on the release of the FOMC’s latest meeting minutes where policymakers raised rates by 25 basis points.

Technical Analysis:

- AUD/USD is extending choppy trade around 50-DMA

- Volatility is high and momentum is bearish, RSI is below 50

- MACD and ADX support downside in the pair

- Recovery in price has been capped at 200H MA

Major Support and Resistance Levels:

Support - 0.6827 (110-EMA), 0.6802 (200-DMA)

Resistance - 0.6935 (21-EMA), 0.6978 (20-DMA)

Summary: AUD/USD struggles to extend recovery. Technical indicators are biased lower. Scope for retest of 200-DMA support. Break below 200-DMA will drag the pair lower. Bearish invalidation only above 20-DMA.