The Aussie dollar jumped as the 1.1% gain in Q1 GDP is a stronger result than forecasted at 0.6% (previous 0.7%) and suggests that the economy is weathering the downturn in mining investment well. Solid consumer spending and strong growth in both housing construction and services exports are helping to drive the transition to non-mining growth.

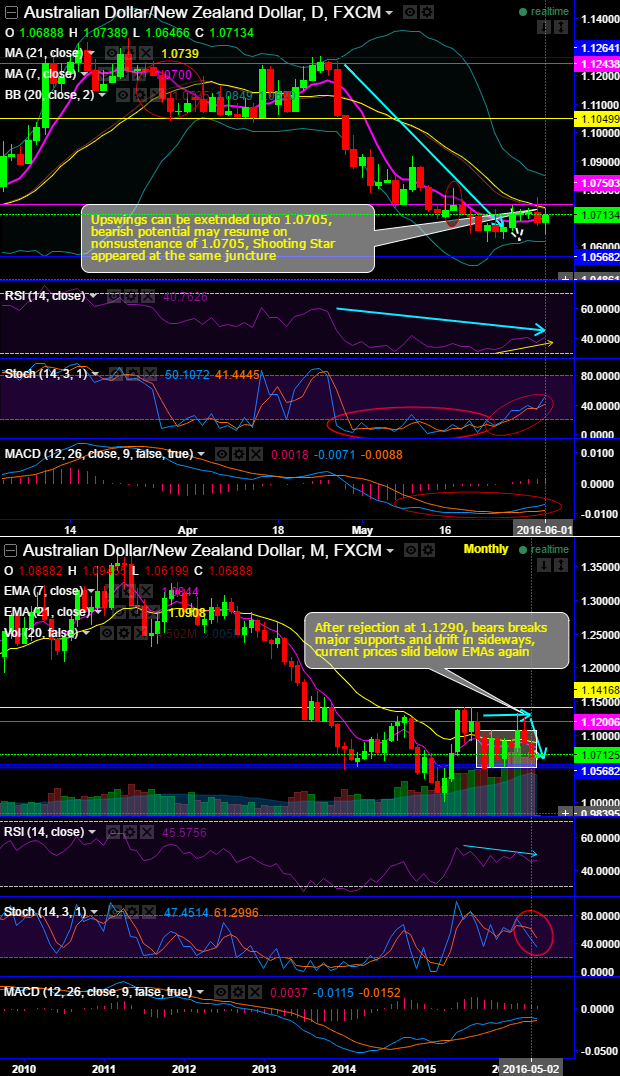

Technically, we kept reiterating the pair hasn't been able to clear levels of 1.0705.

Even though the current prices today have bounced a bit, we perceive them as momentary and these gains are evidenced mainly owing to data events.

The current upswings are testing resistance at 21DMA.

Having said that, if the interim bulls are able to clear these levels capitalizing on momentum offered by the leading oscillators then upswings would be extended upto 1.0705 again.

On the contrary in broader perspectives, the pair is drifting into sideways (see monthly charts), where momentum and trend oscillators substantiate this sideway trend.

To match both these short term and long term trend puzzling, a brief upswings were constrained at 1.0705 in the recent past as well. That's where a shooting star pattern is traced out exactly at 1.0749 levels while breaking supports at 1.0750 levels.

The current prices have consistently slid below DMAs and they are slipping through 7DMA.

Daily RSI is converging clearly to the momentary bounces, while slow stochastic curves also signals momentum in short term rallies.

Trade Tips:

For today, we don't want to miss the bullish sentiments but tackle these rallies with cautious approach. Well, this could be done using boundary binaries.

Intraday speculators can eye on boundary binaries keeping 1.0730 as upper bracket (adding tolerance by 0.25% to 1.0705) and 1.0670 as lower bracket.

Nevertheless, short term bears can eye on shorts in mid month futures for targets of 100-150 pips (i.e. upto 1.0629) but with stiff stop loss of 1.0730.