ATM IVs of 1w expiries are just shy above 5.2%, and seems unlikely to pick up the pace. Growing in snail's pace even in 1m tenors.

As a result, the delta neutral trading strategy, in this case, involves the buying of a theoretically underpriced OTM option (because the considerable disparity exists between ATM premiums and IVs as shown in the diagram) while taking an opposite position in EURCHF options.

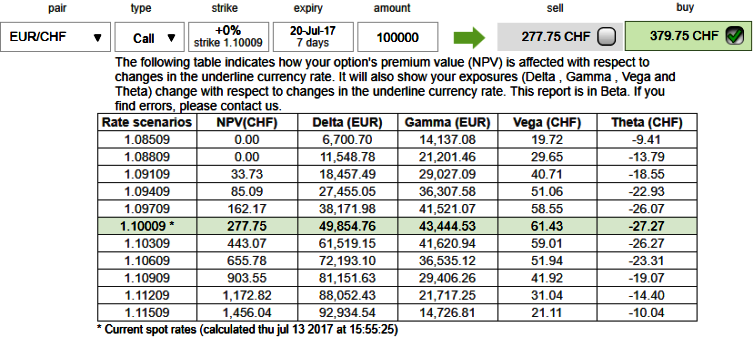

Well, thereby, a common question pops up after this explanation is that, "how do we know if an option is theoretically underpriced?" we prefer to use Option Greeks platform that provides this information.

1w EURCHF ATM calls are trading at 36% more than Net Present Value.

Comparing reasonable delta contents, ATM IVs and option premiums with net present values of such premiums will give you the theoretical price of an option.

Here, the implied volatilities of ATM contracts are just above at 4.5% for next 1-3 months horizon.

So if anyone anticipates it can still be possible to extract returns from this nerdy volatility scene from this pair, even though exhausted bulls who think the long lasting non-stop streak of the bull run to take a halt at this point. Yes, that's quite achievable from iron butterfly strategy.

To execute this strategy, the options trader assumes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

At Spot reference: 1.10, iron butterfly strategy (EURCHF) can be executed as shown below,

Long 2M (1%) OTM -0.26 delta call & short ATM call with positive theta or closer to zero + short ATM put with positive theta or closer to zero again & long 2M (1%) OTM -0.27 delta put.

In the iron butterfly, there is the high probability of deriving certain yields as it contains both bull call and the bear put spreads, hence it would likely yield variant payoffs from classic butterfly spreads.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data