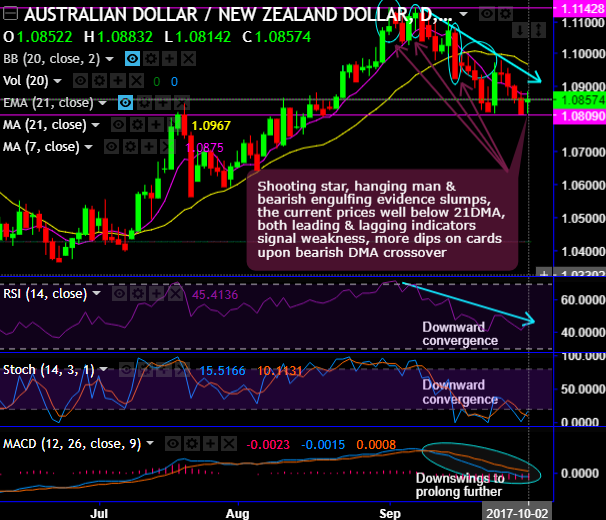

On daily terms, the stiff resistance is rejected at 1.1142 levels.

That is where, we’ve already stated that the series of bearish pattern candlesticks, such as, Shooting stars, hanging man & the bearish engulfing candles have occurred at 1.1083, 1.1054, 1.1126, and 1.0921 levels respectively.

As a result, it is evident that these bearish patterns evidence considerable slumps, the current prices are well below DMAs despite today’s rallies.

Both leading & lagging indicators signal weakness, RSI and stochastic curves that indicate strength and momentum in the downtrend that’s been consistently converging downwards to the price dips.

For now, more dips seem to be on cards as 7DMA crosses below 21DMA which is a bearish DMA crossover. While another lagging oscillator (MACD) also signals downswings to prolong further.

On the flip side, it has tested strong support at 1.0809 levels for today, but no substantiation is observed from any other indicators, so, it shouldn’t be studied in an isolation.

The major trend has been sliding back in the sloping channel (refer monthly charts), the current prices spike above EMAs but attempt to slide back in the sloping channel.

Overall, the resumption of the major downtrend is on the table, even if you any abrupt upswings, that shouldn’t be deemed as panicky sentiment.

Thus, contemplating above technical rationale, on speculative grounds we advocate boundary binaries with upper strikes at 1.0883 (8 pips above 7DMA) and lower strikes at 1.0809 levels (strong support).

The trading between these strikes likely to derive certain yields and more importantly these yields are exponential from spot movements.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.0883 > Fwd price > 1.0809).

Alternatively, with a view to arresting downside risks, foreign traders are advised to initiate shorts in futures contracts of near-month tenors.

Currency Strength Index: Ahead of RBA cash rate announcement, FxWirePro's hourly AUD spot index is flashing at -21 levels (which is mildly bearish), while hourly NZD spot index was at shy above 13 (which is neutral) while articulating. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?