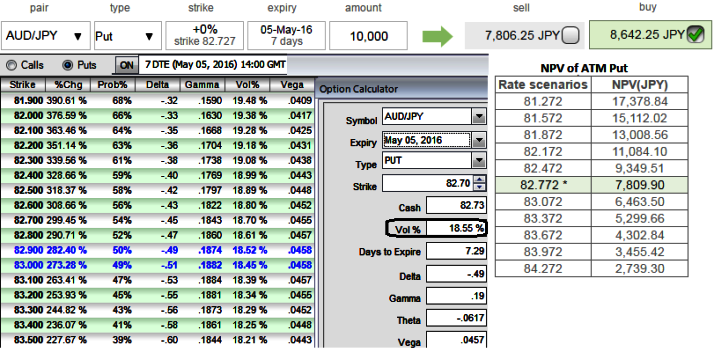

As shown in the diagram The ATM IVs of AUDJPY of 1W expiry is at around 18.55%.

While, 1W ATM puts are priced 10.66% more than Net Present Value.

Sensitivity tool signals more positive change in premiums in OTM strikes scenarios.

Thereby, one can initiate trading or hedging strategy using OTM puts which would be even more cheaper or arbitrage using below strategy also.

A synthetic long put can be created when short spot FX is combined with a long call of the same series.

The synthetic long put is so named because the established position has the same profit potential as long put.

And the same also shows high probability numbers for OTM strikes when compared to the ITM strikes, which means these the ATM puts will have higher likelihood of expiring in the money.

Since, it has been broken the support at 84.001 on intraday terms, we can understand how bears are active at the right time in this pair, no wonder if it hits 82.685 levels again or oscillates between 83.160 and 82.685 levels as you can see the convincing volumes and technical indicators favouring bears on monthly charts.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed