European PMI data continues to indicate slowing growth momentum.

The manufacturing PMI fell to 50.5 from 51.4 with services PMIs are flashing at 50.8 from 51.2.

The PMIs are at their lowest since November 2014 with new orders falling to 47.9 (the lowest since April 2013).

All these leading fundamental indicators signal the region’s economic health and how businesses react quickly to market conditions, how their purchasing managers hold perhaps the most current & relevant insight into the company's view of the economy.

While the ECB held rates and stuck to the script: rates on hold until the second half of the year and repurchases will end well after the first rate hike. That said, Draghi delivered a dovish tone, saying that risks have moved to the downside with data consistently disappointing over the last couple of quarters and geopolitical risks brewing. He mentioned there were some discussions about increased TLTROS, but the case needs to build further.

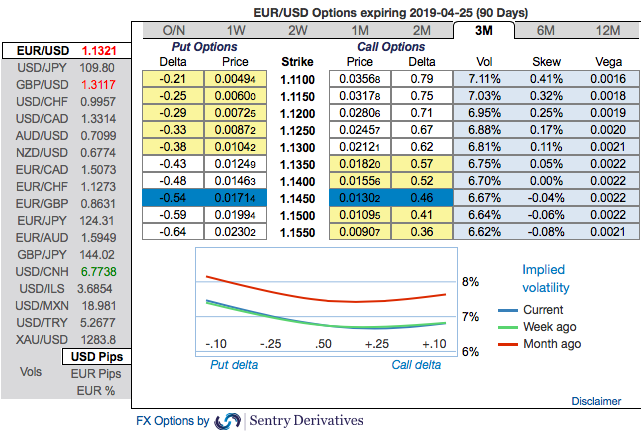

OTC indications:EURUSD 3m positively skewed IVs have been signalling downside risks

Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

To substantiate these indications, we observe the fresh bids to mounting negative RRs in the 1m coupled, while bearish neutral RRs in the longer tenors remains intact which is in line with the above-stated bearish scenarios.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing put holders for further downside risks of euro. Courtesy: Sentrix & Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -92 levels (which is bearish), while hourly USD spot index was at -6 (neutral) while articulating (at 08:44 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data