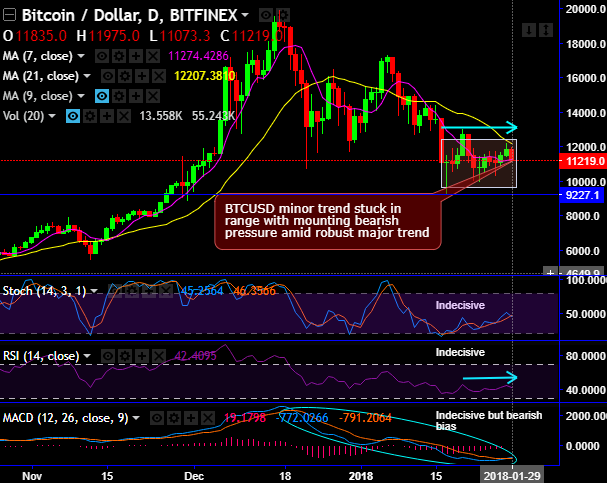

BTCUSD has been stuck in a range ever since the dragonfly doji has occurred, currently, the BTC price has been oscillating between 7 and 21 DMAs levels.

As you can observe the daily plotting of BTCUSD on BITFINEX exchange, the minor trend is stuck in a tight range (refer daily plotting) but with some mounting bearish pressure amid robust major trend (refer monthly chart).

BTC futures trading opened the door for pessimists to participate in the trading, that seems to have previously been ruled by genuine followers. Now the pessimists have nudged bitcoin’s price down harshly. Since closing at a peak above $19,000 on December 18 — on the first day of futures trading — bitcoin has lost almost half of its value.

Well, these price actions are majorly due to the underlying news, likewise, predominantly the recent price stability is still owing to the lingering constructive underlying news that’s holding BTC prices.

On the contrary to the lingering bearish signals in BTCUSD technical charts, we spotted out a few set of constructive news that is discussed as below.

The costs, lack of transparency and time taken to establish letters of credit meant the trade finance process was ripe for disruption. In 2016 four students from the Massachusetts Institute of Technology (MIT) decided to challenge the status quo and launch a platform that would connect in real time buyers and sellers of goods, and put back trust into trading relationships.

The team’s bluechip background in commercial banking and commerce meant they understood the workflows and risk profiles, and being entrepreneurs saw the potential of how blockchain technology could deliver a transformational experience and operating system. Indeed, this is seemingly a good news for bitcoiners.

Elsewhere, WeMakePrice, the leading South Korean e-commerce shopping mall has latently publicized that it would be accepting cryptocurrency payment methods, thereby, the twelve different types of cryptocurrencies, including Bitcoin, Ethereum, and Ripple are in the limelight for now. According to Korean news source YonHap News, the move comes as part of a partnership with virtual currency exchange Bithumb.

Alright, we saw both positive as well as negative news attached to the bitcoin. However, most importantly we at EconoTimes come up with a wise options strategy for those who are sitting with the BTC investments but for now having a dubious eye on its further bull run amid prevailing bearish sentiments. Let’s just have a glance through below options trading strategy that could fetch you the profits even when the underlying BTC prices slide down.

Covered call option strategy:

When you see the above technical charts, it would probably be luring factor for you (if you are a fresh trader) or frustrating thing (if you are already holding a coin) to short this pair. But, how would you like your account value to be protected even if the price of BTCUSD retreats slightly?

Enters the Covered Call options strategy! The Covered Call, also known as a Covered Buy-Write or Covered Call Write, is the classic of classics in options trading. This is the options trading strategy that most beginners learn about and is also the options trading strategy most widely taught.

One should use a covered call when one wishes to hold on to one's stagnant asset price while making constant income from it. One can also use a covered call to protect one's equity when the BTC goes into a slight correction.

A covered call comprises basically of writing 1 contract of out of the money call options for every 1 bitcoin owned.

If buy a bitcoin, simultaneously, short 1 lot of 1% OTM Call of the 2w tenor as shown in the diagram. When BTC slide or remains stagnant, the position is likely to fetch certain yields in the form of initial premium received.

It would essentially be executed in 3 ways; simultaneous order, underlying asset protection or short covering.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty