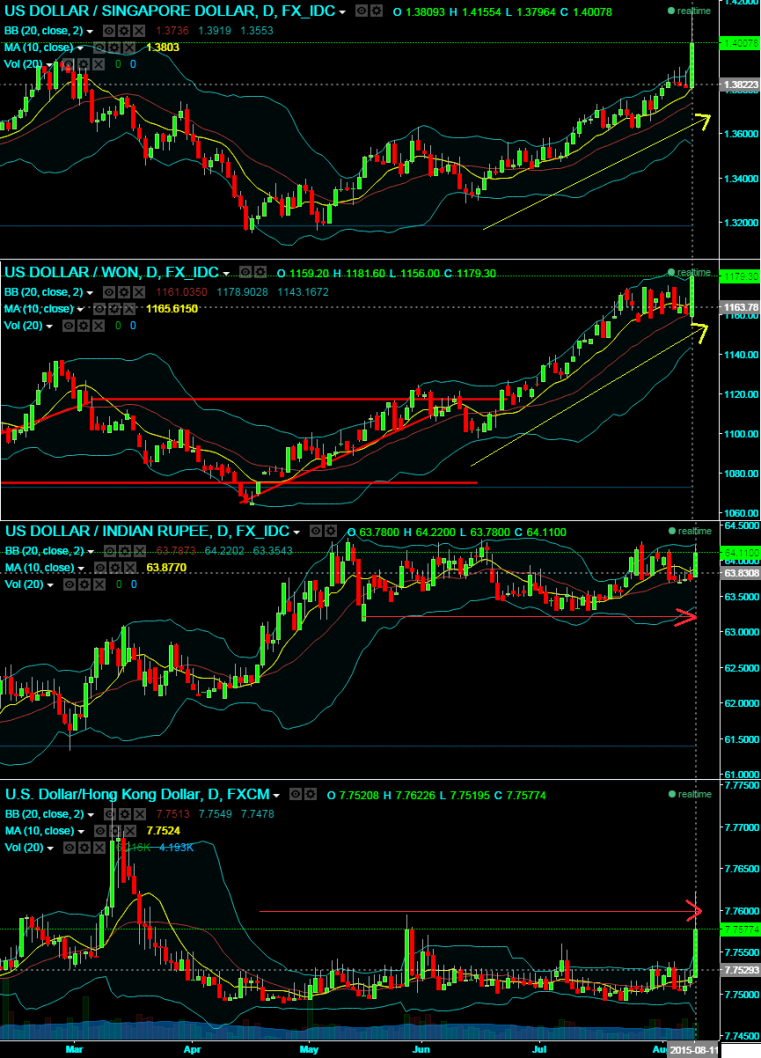

Can Chinese currency devaluation be perceived as unusual object or is this signing a trend? This devaluation as a one-off but it is quite a vital juncture because this is a big shift in the way the Chinese central bank is managing their currency. Until this time they have sort of tried to maintain a firm grip on their exchange rate but now they are allowing market forces to play a much bigger role. This one-off adjustment that happened today was to try and align the fixing which the central authorities have been maintaining which has deviated quite substantially from the actual trader rate. While it will have major one-day impact on other Asian currencies including the Singapore dollar, Korean won and Indian Rupee.

USDKRW: The above currency valuation has just been booster for this pair's prevailing uptrend, we look ahead with shrewdly for any dips to capture an ideal entry prices, thus e believe any dip below 1175.24 is good buying element.

USDSGD: Nothing wrong about the SGD losing its currency value against greenback, these spikes would be deemed as continuation pattern for uptrend in this pair that has affected the pair from its external factors, hence we like to remain longs on this pair on every dips.

USDINR: This has been mere temporary pressure and has certainly disturbed Indian currency for its accurate valuation, technically we don't see the pair moving above 64.3013 should not sustain. Hence, we are sell on this pair on every upswing.

USDHKD: Again the similar scene for HKD as Indian currency, since international trade business in Hong Kong is in close association with China we see disturbance from Chinese currency measures. Otherwise we would either remain sideways or gains on HKD.

FxWirePro: Asian currency exotics to tumble further on PBoC currency management mechanism

Tuesday, August 11, 2015 7:25 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary