The benchmark interest rate in Singapore was last recorded at 0.46 pct.

While the Fed looks through the rise in prices, the real exchange rate would appreciate. A week that delivered hawkish Fed testimony and a solid set of upside data surprises failed to deliver a stronger dollar. This inability to sustain a rally despite a perfect overlap of hawkish fed and bullish data this week, suggests we might need something more phenomenal for the USD to materially retrace back to January highs, much less a break of new highs.

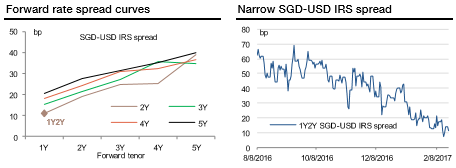

A bearish FX scenario is figured out in asymmetric risk as SGD rates have outperformed USD rates for an extended period (since February 2016), first characterized by easing in SGD rates which was followed by resilience in SGD rates amid rapid increases in USD rates.

We believe SGD-USD IRS spreads will widen from here, and encourage interest rate swaps to mitigate the resilience between currencies and rates.

First, we remain bearish towards SGD, while implied rates are not reflecting it at all being more impacted by the liquidity situation. The risk is to the upside for implied SGD rates should the FX view becomes more influential.

Second, the MAS is likely to keep policy unchanged in April, but in the small chance that they do something it will be in the direction of easing rather than tightening, on economic weakness.

Third, a much more constructive EM sentiment is needed to further push SGD rates lower vis-à-vis USD rates. The phenomenon of SGD rates persistently lower than USD rates in 2014 is unlikely to repeat.

Fourth, FX swap flows for USD funding needs should mainly impact the short end (below 1Y tenor).

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand