AUD should hold around current levels near-term, before declining towards USD 0.73 by the Q2 end. The projection track expects AUDUSD to hold around the USD 0.75-0.77 levels through 2Q’18.

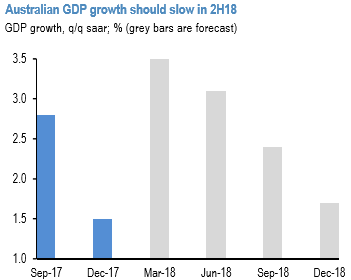

We expect both monetary policy divergence and modestly weaker commodity prices to push the currency lower. We are also expecting the pace of domestic growth momentum to decline in 2H’18, after a boost from net exports in the first half of the year (refer 1st chart).

In 2018, the main bearish risk to AUD comes from a lift in market volatility, we noted that a regime shift from low to high-vol can drive non-linear moves in AUDUSD as carry preferences switch.

This was certainly borne out in February, with sharp moves on global equity markets driving a rapid adjustment in AUDUSD to the downside.

OTC outlook and hedging perspectives:

While using rising IVs of longer tenors coupled with the bearish neutral risk reversal numbers, while positively skewed IVs on 3m OTM put strikes could be interpreted as an opportunity to deploy longs in OTM puts with theta shorts in ITM put on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Without disregarding the Fed’s further rate hiking cycle in 2018, the bearish stance of the pair has been substantiated by technical indications (as stated in our recent post, refer our technical section) and positively skewed IVs of 3m tenors which is an opportunity for put longs in long-term as the US central bank likely to continue hiking phase.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies by bidding 3m theta shorts, 3m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of OTM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 3m (1%) ITM put option, simultaneously, go long in 2 lots of vega long in 3m (1%) OTM -0.39 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 60 levels (which is bullish). Hourly USD spot index was at shy above -44 (bearish) while articulating (at 08:38 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data