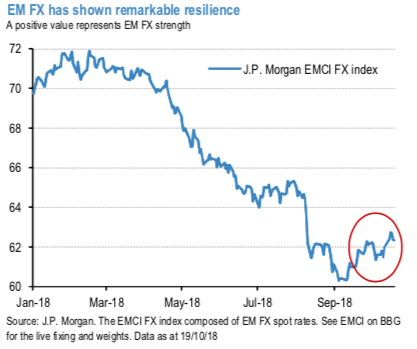

EM FX has shown remarkable resilience against the backdrop of multiple headwinds. October has thrown up a number of potential headwinds to challenge EM FX risk sentiment, in the form of heightened US equity volatility (the S&P500 is down 5% MTD), higher US rates (with the 10-year now back at 3.20%) and a continuation in US-China trade tensions.

However, against this risk-off environment, EM FX has been remarkably resilient, with the J.P. Morgan EMCI index strengthening 0.6% MTD (refer above chart).

China’s official manufacturing PMI came in at 50.2 for September, down sharply from 50.8 in the prior month. This is the lowest reading since July 2016, clearly illustrating a sluggish momentum and pointing to a gloomy growth outlook. Looking ahead, the authorities could step up outright stimulus to support the economy. Certainly, the CNY is under pressure to depreciate due to sluggish growth outlook and further monetary policy.

However, the PBoC needs to carefully manage the CNY exchange rates as the market could be shocked if China’s central bank easily gives in the 7.00 line for USD-CNY. Certainly, this is not an easy task for the PBoC, and naturally we can expect that the authorities will continue to tighten the capital controls. Relatedly, China’s central bank announced this morning to issue PBoC bills in Hong Kong on 7 November. This is the first-ever PBoC bill issuance in offshore market, indicating that the PBoC intends to increase the cost of funds in offshore market to squeeze the short yuan positions. While the volume is quite small – CNY10bn at 3-month tenor and CNY10bn at one-year tenor, this clearly signals that China’s central bank is very keen to stabilize its currency especially at 7.00 hurdle.

Hence, we added a long outright 1yr USDCNH recommendation at 7.01. We also retain our fwd-fwd 3s-6s forward steepener in USDCNH.

Alternatively, a zero-cost option implementation is proposed for owning USDCNH upside by buying USD calls/CNH puts financed by selling AUDCNH strangles (live, no delta-hedging): Off spot refs. 6.96 (USDCNH) and 4.90 (AUDCNH), buy 9M 7.12 strike (40-delta) USD calls/CNH puts vs short 9M OTM 4.50 – 5.30 AUDCNH strangle, equal CNH notionals/leg for zero-cost. The USDCNH call costs 165bp standalone (mid). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 98 levels (which is bullish), and hourly USD spot index has bearish index is creeping at 22 (mildly bullish) while articulating (at 11:49 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics