We could increasingly foresee upward risks for the USDCNY forecast. Even if we see clear signals that the Chinese central bank PBoC is leaning against CNY depreciation, the depreciation pressure on the renminbi is not easing.

However, we still assume that the PBoC will not abandon the psychologically significant 7 mark lightly. This could trigger a capital flight that would make it all the more difficult for Chinese leaders to maintain financial stability. Nevertheless, we believe that the longer the trade conflict with the US lasts and the clearer the economic consequences become, the more likely it is that the 7 level will be breached earlier than we anticipated.

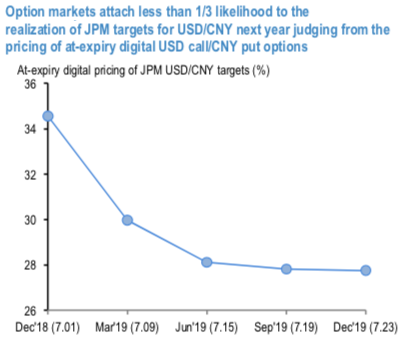

JPMorgan’s adoption of a new baseline of 25% tariffs on the entire stock of Chinese exports to the US has necessitated a downward revision to next year’s CNY targets: our Asia strategists now project USDCNY to hit 7.15 by June’19 and 7.23 by Dec’19 (Larger CNY depreciation now likely but fiscal policy currently in play).

Option markets do not fully buy into this bearish CNY narrative judging from the pricing of at-expiry USD call/CNY put digital options: The above chart exhibits that the option implied probabilities of reaching or exceeding JPM targets are less than 1/3rdacross nearly all horizons. The implication is that there is likely to be substantial market impact if our bearish CNY view is realized, hence it pays to consider positioning for levered medium-term renminbi depreciation.

Tactically, focus on CNY has ramped up again after a few weeks of stability as China escaped being labelled a manipulator in the latest Treasury report on currencies and appeared to permit a move higher in USDCNY towards 6.95.

We propose a zero-cost option implementation for owning USDCNH upside by buying USD calls/CNH puts financed by selling AUDCNH strangles (live, no delta-hedging): Off spot refs. 6.9474 (USDCNH) and 4.8589 (AUDCNH), buy 9M 7.12 strike (40-delta) USD calls/CNH puts vs. sell 9M 4.60 – 5.20 AUDCNH strangle, equal CNH notionals/leg for zero-cost. The USDCNH call costs 165bp standalone (mid). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CNY spot index is flashing at 5 levels (which is neutral), hourly USD spot index was at 105 (bullish) while articulating at (14:25 GMT). For more details on the index, please refer below weblink:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed