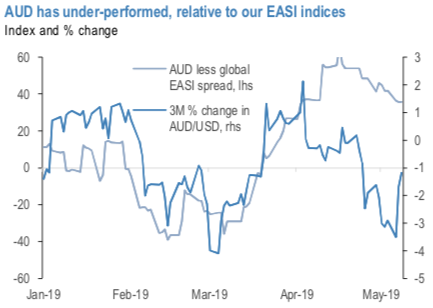

Despite local data continuing to out-perform relative to the global data flow (refer 1stchart), AUDUSD has under-performed of late, kept in check by a slow-burning negative domestic narrative, a re-escalation of trade war risks and the RBA’s gradual progression towards a more dovish policy stance.

Indeed, the RBA took another step towards a dovish policy bias this week, when it adjusted the last paragraph of its monthly Statement. We had expected the RBA to cut rates in May in light of the weak 1Q CPI data, but in the end this proved not to be a strong enough trigger.

Still, it can be argued that the RBA took a step towards rate cuts this month; previously, the Bank had indicated that a rising unemployment rate would be necessary to guarantee rate cuts. Now, improvement in the labour market appears to be a necessary condition for policy stability. This is clearly a weaker pre- condition for easing, and we now expect 25bp of easing in August, followed by another 25bp in November.

Consequently, the market is still priced for rate cuts (refer 2ndchart), which has kept pressure on front end rate differentials as the Fed has pushed back against the idea of an insurance cut.

The contrarian view on AUD of late has been that a combination of Chinese stimulus and good news on US-China trade relations will be supportive of the currency. Recent developments on this front have been mixed; generally China data has printed with a better tone, and last month our Chinese economists revised up their 2019 calendar year forecasts for Chinese growth to 6.4% (from 6.2%). But news on the US/China trade deal has soured this week, with heightened risk the US announces an increase in tariffs on $200bn of Chinese imports.

The majority of the Aussie pairs are dragging price dips today on the back of the Chinese domestic demand saw broad-based easing in April.

AUDUSDdipped -0.20%, EURAUDclimbs +0.27%, whileAUDJPYslipped about -0.37%, and so is AUDNZD(down by -0.11%).

Advances of retail sales decelerated from 8.7% YoY in Mar to 7.2%, the slowest growth since 2003.

Industrial production and investment fell to 5.4% and 6.1% (YoY YTD) from 8.5% and 6.3%.

We will now shed some light on the OTC outlook of AUD, before proceeding further into the options strategic framework.

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.67 levels which is in line with the above bearish scenarios (refer IV nutshell).

Please also be noted that mounting numbers of bearish risk reversals and bearish neutral RRs of the 3m tenors that are also in sync with the bearish scenarios refer (Refer risk reversal nutshell).

Overall, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear. Courtesy: Sentrix, JPM & Saxobank

Currency Strength Index: FxWirePro's hourly AUD is flashing at -20 levels (mildly bearish), while hourly USD spot index is at 2 levels (which is absolutely neutral) while articulating at (10:44 GMT).

For more details on the index, please refer below weblink:http://www.fxwirepro.com/currencyindex

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios