AUD opened higher following G20, while Yen has sold off. Despite a marginal improvement in trade sentiment supporting risk, the short-term AUD outlook remains more neutral ahead of the RBA on Tuesday.

And so is the functions in OTC FX markets for AUD (no change in the RRs). Of late, the Aussie dollar has gained little upside traction momentarily, spiked from the lows of 0.6831 to current 0.6998 levels. RBA is scheduled for their monetary policy on 2ndJuly. The weaker growth and RBA rate cuts most likely to drive AUD’s vulnerability, the projections are at USD0.66 levels by 4Q’2019 ahead of the above event.

RBA took a step towards rate cuts in the recent past; previously, the Bank had indicated that a rising unemployment rate would be necessary to guarantee rate cuts.

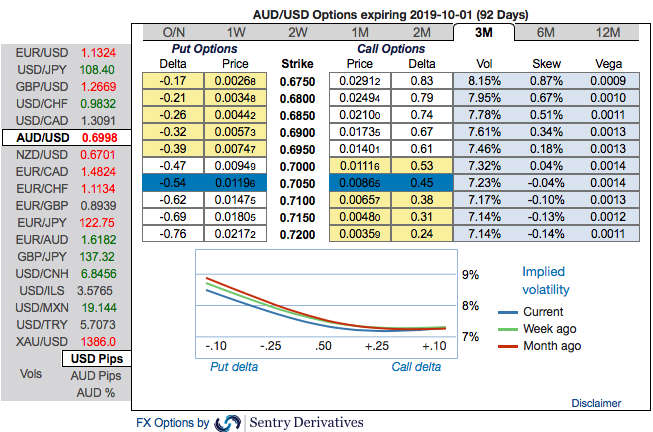

OTC updates: We will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes up to 0.6750 levels which is still in line with the above bearish trend (refer 1stnutshell).

Please also be noted that the bearish neutral risk reversal numbers but the negative RRs of across all the tenors that are also in sync with the bearish scenarios refer to 2nd (RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

The rationale: Contemplating all the above factors, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m lower IVs to optimize the strategy.

Bearish outlook with rising volatility good for the option holder.

While put writers would be on the upper hand on theta shorts in OTM put options that would go worthless on lower IVs as the underlying spot FX keeps rising. Thereby, the premiums received from this leg would be sure profit.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix and Saxobank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 92 levels (which is bullish), while hourly USD spot index was at 26 (mildly bullish) while articulating (at 08:47 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom