The AUD held onto gains following the RBA Governor’s speech yesterday. Today, the focus would be on China’s activity data following strong lending growth reported yesterday. Firm production data may see the AUD continue to rise.

In his first speech as RBA Governor, Philip Lowe reinforced the flexible nature of the RBA’s inflation target while emphasizing that the Bank continues to expect inflation to stay low.

The key considerations for policy continue to be inflation and the housing and labor markets. Inflation expectations are also important.

We continue to see rates on hold at 1.5% for an extended period, although with inflation set to stay low for some time, the risks remain tilted to the downside.

Technically, AUDJPY may extend rallies further but we could foresee major hurdles at 79.834 and 80 levels, while the major downtrend still seems intact.

Hedging Strategy:

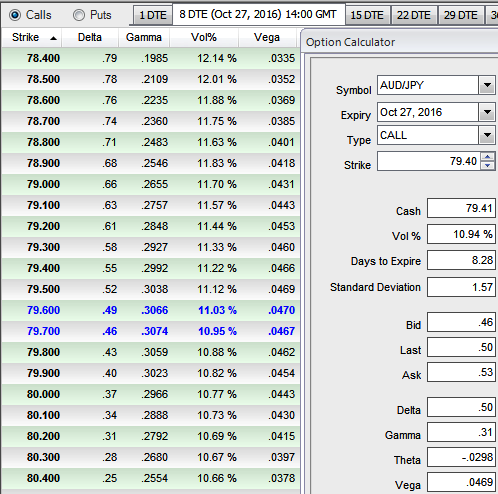

If you're the skeptic on ongoing rallies to have a restricted upside potential and expects abrupt declines then the below strategy is advisable. 1w ATM contracts are perceiving IVs at a tad below 11%.

Ideally, this is an option trading strategy that is constructed by holding underlying spot FX while simultaneously buying the protective put and shorting calls against that holding.

Well, the strategy goes this way: while you're holding longs in spot FX of AUDJPY, go short in 1W (1.5%) OTM striking call and long in 1W (1%) OTM striking put. Since the short term bullish sentiments are mounting we kept upside bracket little on the higher side.

This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security.

This serves as an economical strategy to deploy if you are writing covered calls to earn premiums but wish to protect yourself from an unexpected sharp drop in the price of the underlying spot.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices