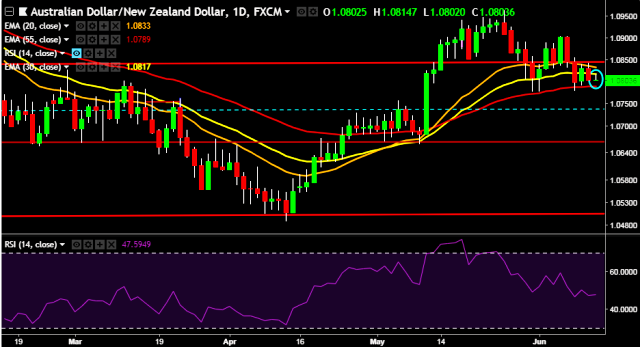

- AUD/NZD is currently trading around 1.0803 marks.

- Pair made intraday high at 1.0814 and low at 1.0800 marks.

- Intraday bias remains neutral till the time pair holds key support at 1.0775 mark.

- A sustained close above 1.0802 will drag the parity higher towards key resistances at 1.0850/1.0927/1.0998/1.1072/1.1122 levels respectively.

- Alternatively, a daily close below 1.0802 will take the parity down towards key supports around 1.0776/1.0736/1.0620/1.0572 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- Australia June Westpac consumer sentiment increase to 0.3 % vs previous -0.6 %.

- Australia's S&P/ASX 200 index down 0.27 pct at 6,037.80 points in early trade.

- RBA governor Lowe will deliver a speech around 0200 GMT titled "Productivity, Wages, and Prosperity" at an Australian Industry Group event, in Melbourne.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest