There was some disappointment in markets this week in Australia as the RBA Minutes did not signal a guarantee of a follow-up rate cut.

Rate cut pricing has been reduced over the last month by around 15bp and now has the first cut priced for May 2017. That said the OIS curve remains extremely flat from November onwards.

Next week, two key indicators will be released: NAB business conditions and May labour force data – both of which can be market movers and have a potential to remove more cut pricing given recent trends.

Elsewhere, China has disappointed by producing CPI data for May showed a drop of 0.5% MoM, more than the 0.2% fall seen, and 2.0% gain YoY, less than the 2.3% increases expected, while PPI eased 2.8%, less than the 3.3% year-on-year drop forecasted.

As a resultant effect, AUDUSD was quoted at 0.7478, down 0.15%, with the currency's fortunes closely linked to trade with China. EURAUD gained from day lows of 1.5190 up to the current 1.5262 levels. GBPAUD surges from the day lows of 1.9312 to 1.9434, whereas AUDJPY tumbles from yesterday’s close of 79.917 to the current 79.218 levels.

We reckon the USD will recover, but the trend will be flatter and more volatile. NZD and AUD remain at risk from global factors, but USD recovery is needed for this to manifest. China-induced volatility is set to continue.

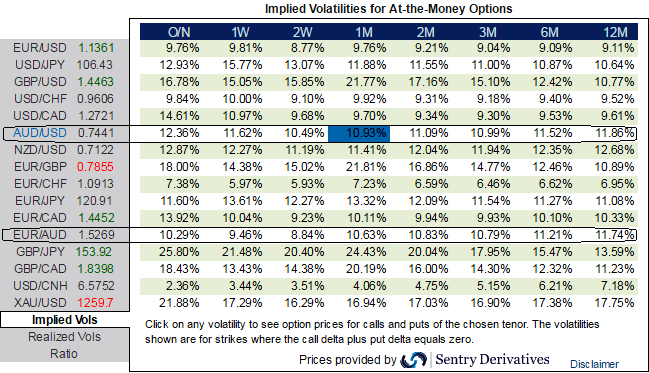

While FX OTC markets for AUD crosses have been quite poised, ATM IVs for AUDUSD and EURAUD of 1m – 3m tenors are a tad below 11%, these vols could be utilized in bearish option spreads on hedging grounds.