The front-end now appears to be well priced with an 80% chance of a 25bp cut by August and a terminal rate of 1.35%.

Timing is everything as they say, and it seems unlikely that the RBA would follow up immediately with a June cut.

With inflation likely to undershoot for some time, further cuts (below 1.5%) are dependent on how willing the RBA is to chase its inflation target.

This decision will ultimately fall to the incoming RBA Governor Phil Lowe (starting in mid-September).

OTC Observation (AUDUSD):

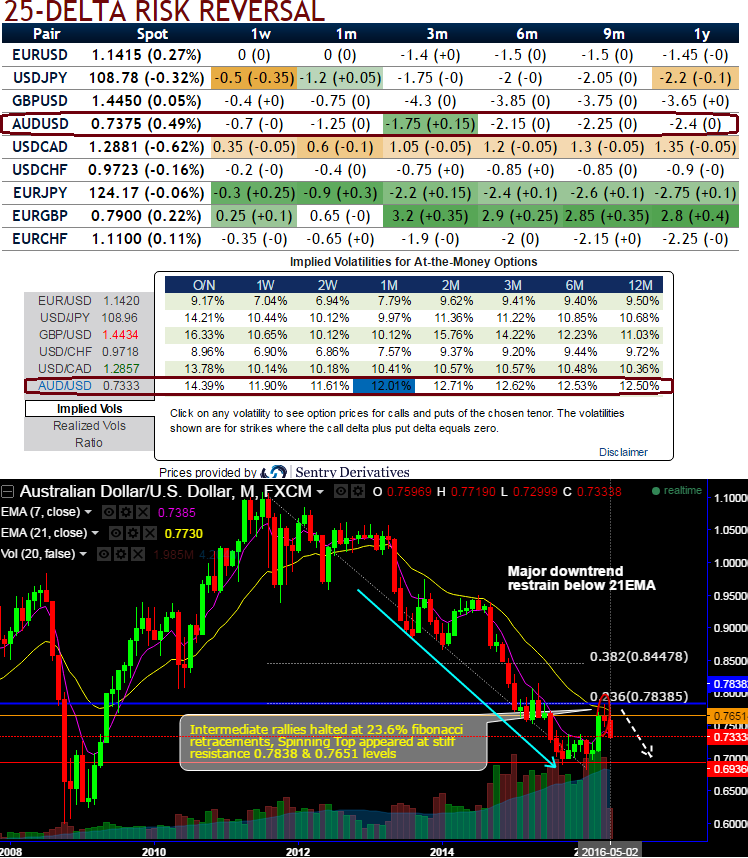

Let’s now have a glance on delta risk reversal numbers of AUDUSD pair.

The pair still signals highest bearish sentiments among G10 currency space in next 1 month’s timeframe.

So, you would cross the threshold into a risk reversal if you want to hedge your underlying risk while lowering the cost of the premiums. Here OTC FX market indicates, this APAC currency pair seems more sensitive towards downside risks, as a result puts looks to be overpriced.

Market pricing well reflects this view that the RBA will ‘eventually’ ease below 1.5%.

If you have:

- Short underlying position in AUDUSD then you would buy a risk reversal (buy a call and sell a put).

- Long underlying position you would sell a risk reversal (buy a put and selling a call).

While, we’re still in middle of May month, within a fortnight AUD/USD has changed its intermediate uptrend mood and dropped almost 5.02% or slumps from the highs of 0.7719 to the current 0.7331 levels.

Technically, major downtrend restrain below 21EMA on monthly charts as rallies were not able to jump above 21DMA and break out above 23.6% fibonacci retracements, that is where bulls have halted and turned table to resume bearish business back in action that signals major trend continuation.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed