Switzerland has reported good set of trade balance numbers today, it is increased from previous 2.86B to the current 3.05B to beat the forecasts at 2.51B.

The pair is likely to evidence bearish swings, while plotting both daily and weekly charts we come across leading oscillators (RSI and stochastic) indicate downward convergence with price slumps. While the current spot FX is sliding below lagging indicator (10DMA) that signifies these price dips to prevail for some more time.

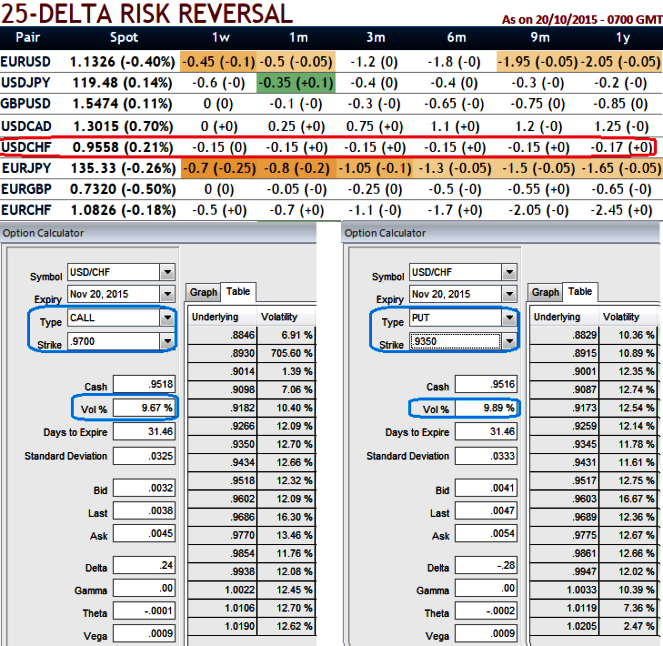

You can observe implied volatilities from the diagram:

While Spot Fx is at 0.9520,

2% OTM put (strike at 0.9350) = 9.89%

2% OTM call (strike at 0.9700) = 9.67%, thus, the risk reversals of ATM contracts of 1 month maturities have no significant disparities between at the money and out of the money instruments.

Hence, pondering the prevailing downswings and FX market sentiments for this pair we recommend buying diagonal combinations instead of option strips because it includes extra cost of hedging.

Here goes the diagonal combination which allows option trader to employ both calls and puts in action.

Shorting the above explained ATM calls with shorter expiry (preferably 3D or 4D) with positive theta and simultaneously add 2 lots of longs on ATM puts with 15D expiry.

When carried out these positions on its own as a leveraged speculation position, buying OTM put + selling OTM call creates a bearish speculation position. Even though using risk reversal for leverage results in a position that ideally requires no capital outlay upfront, it involves element of margin as the short side of the position is a naked writing.

(Caution: risk of execution on short side is associated with this strategy, risk averse should stay away).

FxWirePro: Avoid USD/CHF strips - diagonal combinations for speculation and hedging

Tuesday, October 20, 2015 1:33 PM UTC

Editor's Picks

- Market Data

Most Popular