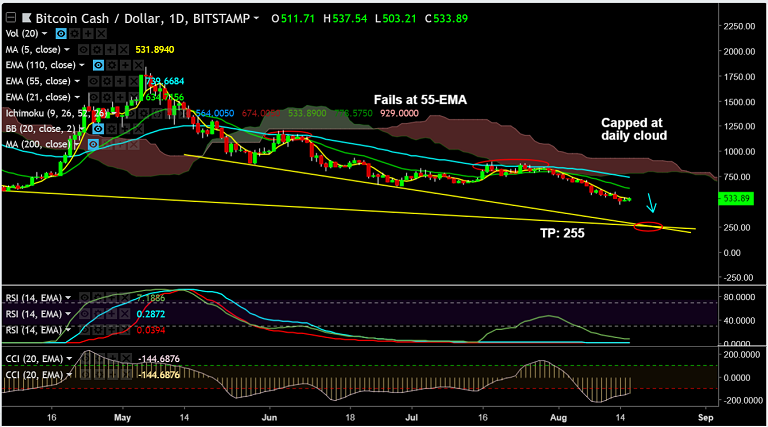

- BCH/USD hovers around 5-DMA at 531 levels, break above could see minor upside.

- The pair trades 4.02% higher on the day at 532.27at the time of writing.

- Price action has hit new lows since Nov 2017 at 471.01 before paring some losses.

- The pair which has been under consolidation since June 2018 has likely resumed downside.

- We are seeing a downward spiral for the 3rd straight week, no respite from bears yet.

- Technical indicators highly bearish and support further weakness, acute declines likely in the pair.

- Downside till 255 (major trendline support) likely. Violation there could see further weakness.

- 55-EMA caps upside and break above could see bearish invalidation with scope for reversal.

Support levels - 471 (Aug 14 low), 400 (psychological mark), 305 (Oct 2017 low), 255 (major trendline)

Resistance levels - 531 (5-DMA), 634 (21-EMA), 739 (55-EMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 61.4331 (Neutral) at 1120 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary