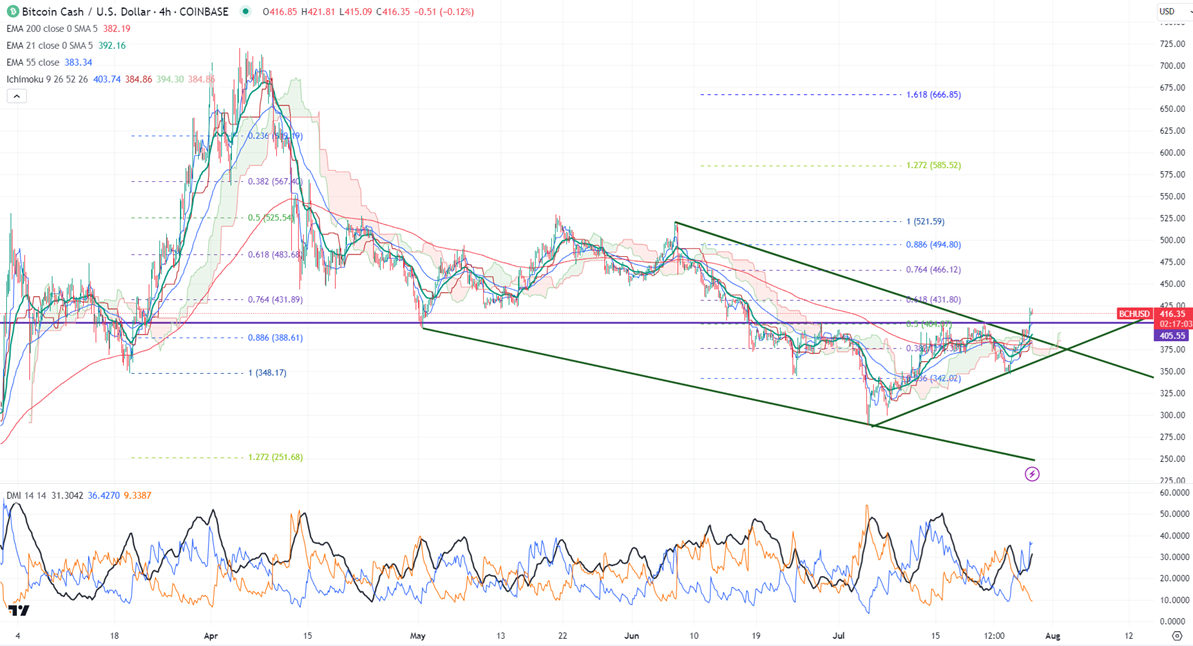

Ichimoku analysis (4- hour chart)

Tenken-Sen- $402.77

Kijun-Sen- $384.86

Horizontal trend line- $405

Downtrend channel resistance- $392

BCHUSD has performed well after a minor sell-off.

Any daily close above $390 confirms further bullishness.

The pair traded weak after forming a minor top around $525 on May 21st, 2024. Any major trend reversal can happen only if it closes above $525.

BCHUSD prices have surged more than 20% in the past three days. It hit a high of $423 at the time of writing and is currently trading around $418.59. The pair holds above the short-term (21 and 55-day EMA) and above the long-term moving average (200-day EMA).

The near-term resistance is around $432, any indicative breach above will take the pair to $466/$500/$525. On the lower side, immediate support is $380, and any violation below targets $345/$300.

Indicators ( 4- hour chart)

Directional movement index - Bullish

It is good to buy on dips for around $400 with SL of around $340 for TP of $520.

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now

Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket

BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket  FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary