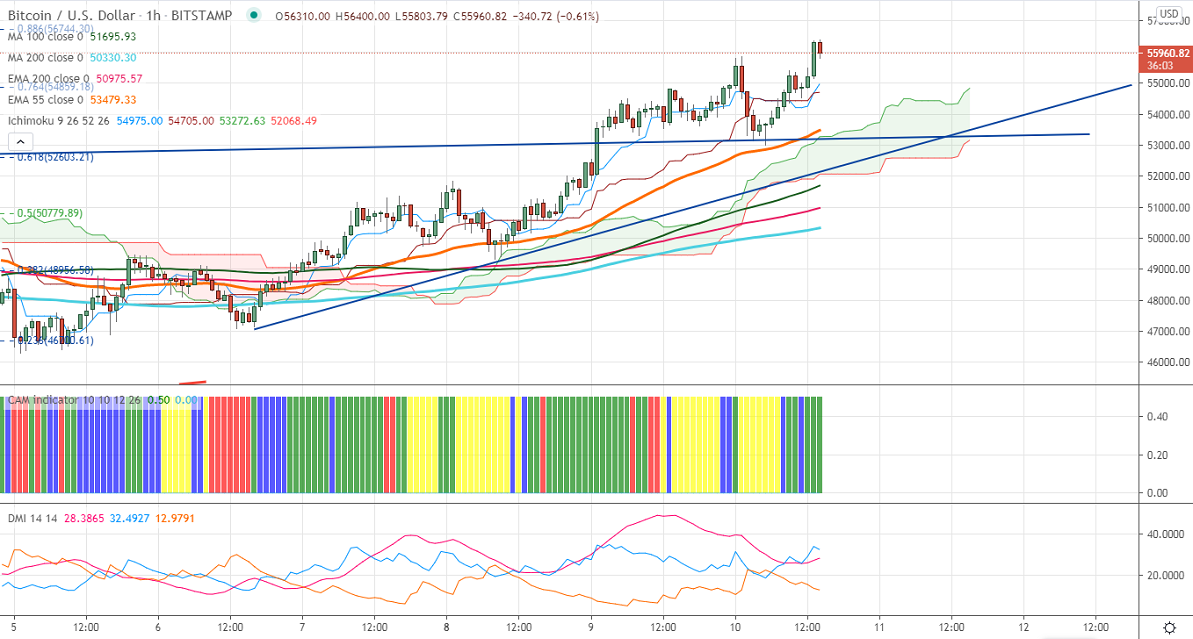

Ichimoku analysis (1-hour chart)

Tenken-Sen- $54681

Kijun-Sen- $54681

BTCUSD took support near 55- H EMA and shown a nice recovery till $56400 on broad-based US dollar selling. The pair is holding above 100- and 200 HMA for the past two days. The intraday trend is bullish as long as support $52850 holds. On Mar 8th, 2021 the pair took support near 200- H EMA. This confirms shows that BTCUSD must close below $50800 for a further trend reversal. The support to be watched is $52500. Any violation below targets $51800/$50925/$50300/$49300.

The pair's near-term resistance is around $56500.Any further bullishness can be seen if it breaks above that level. A jump till $58350 (Feb 21st 2021 high)/$62300 (127.2% fib) is possible.

It is good to buy on dips around $54500 with SL around $53000 for TP of $58350/$62000.