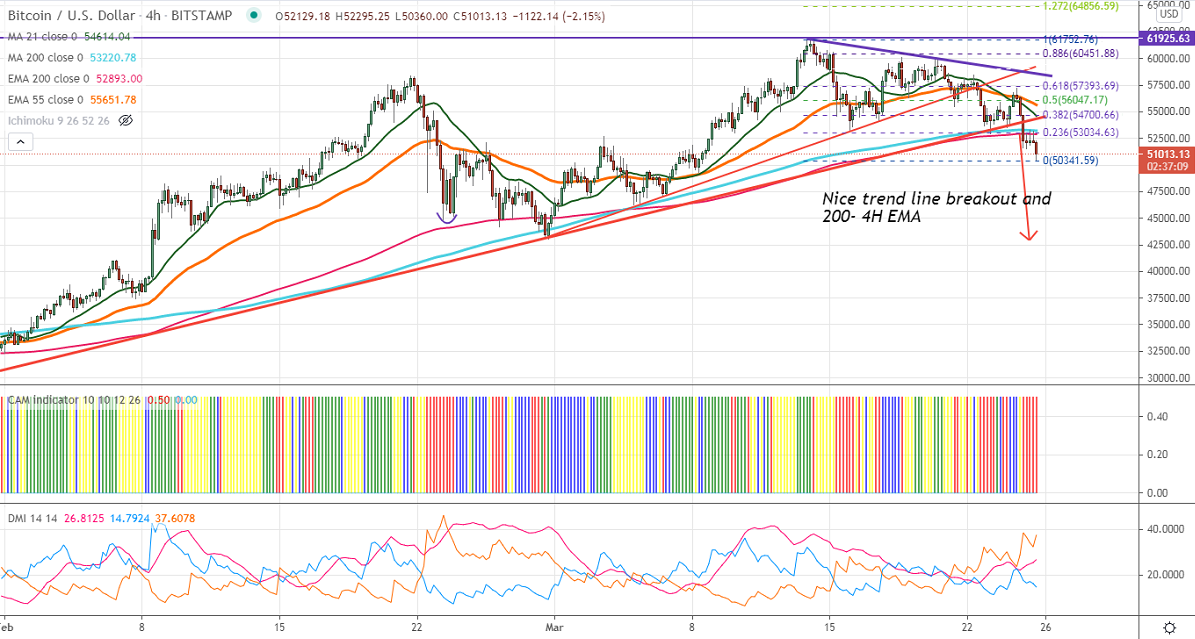

Ichimoku analysis (4-hour chart)

Tenken-Sen- $54355

Kijun-Sen- $54982

BTCUSD breaks significant support at 200-4H EMA and is holding well below that level. The intraday trend is weak as long as resistance $53500 holds. The pair has formed a temporary top around $61700 and started to decline from that level. The pair has formed a double top around $60000, significant trend continuation happens only above $62000. The pair is holding above 4 Hour Tenken-Sen and Kijun-Sen. Any violation below $49300 confirms minor bearishness, a dip till $46550/$43000 is possible.

The pair's near-term resistance is around $53500.Any violation above confirms intraday bullishness. A jump till $54700/$55500 is possible.

Indicator (4 Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $52000 with SL around $53500 for TP of $49300/$46800.