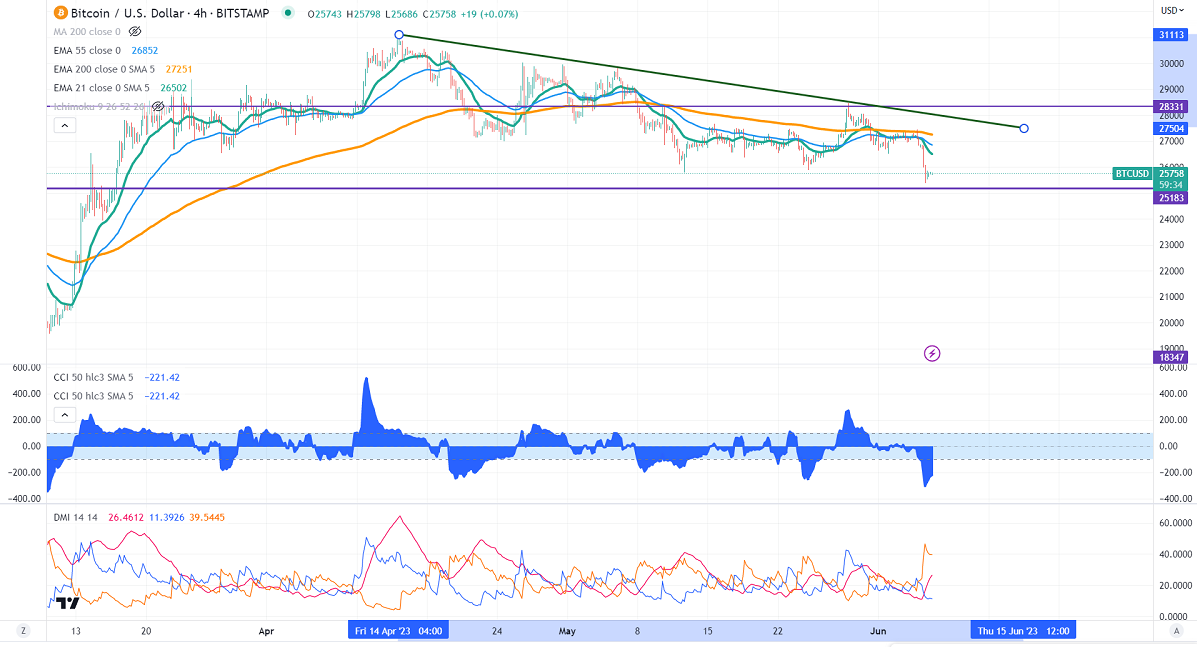

BTCUSD lost its shine after SEC charges against Binance. The Securities and Exchange sued Binance on allegations of violating federal securities law. Bitcoin price liquidation crosses $100 million after SEC lawsuit against Binance.BTC hits an intraday low of $25389 and currently trading around $25786.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC) - Bullish (positive for BTC). The correlation between Bitcoin and NASDAQ diverged and the 40-day correlation dropped to 0.19. Any weekly close above 14600 will take the index to 15000.

According to the CME Fed watch tool, the probability of a no-rate hike in June increased to 77% from 35.80% a week ago.

Technicals-

Major support- $25000. Any break below will take it to the next level at $24300/$20000 if possible.

Bull case-

Primary supply zone -$30000. The breach above confirms minor bullishness. A jump to the next level of $37000/$43200/$48500 is possible.

Secondary barrier- $52200. A close above that barrier targets $60000/$69000.

It is good to buy on dips around $25000 with SL around $23000 for TP of $30000.