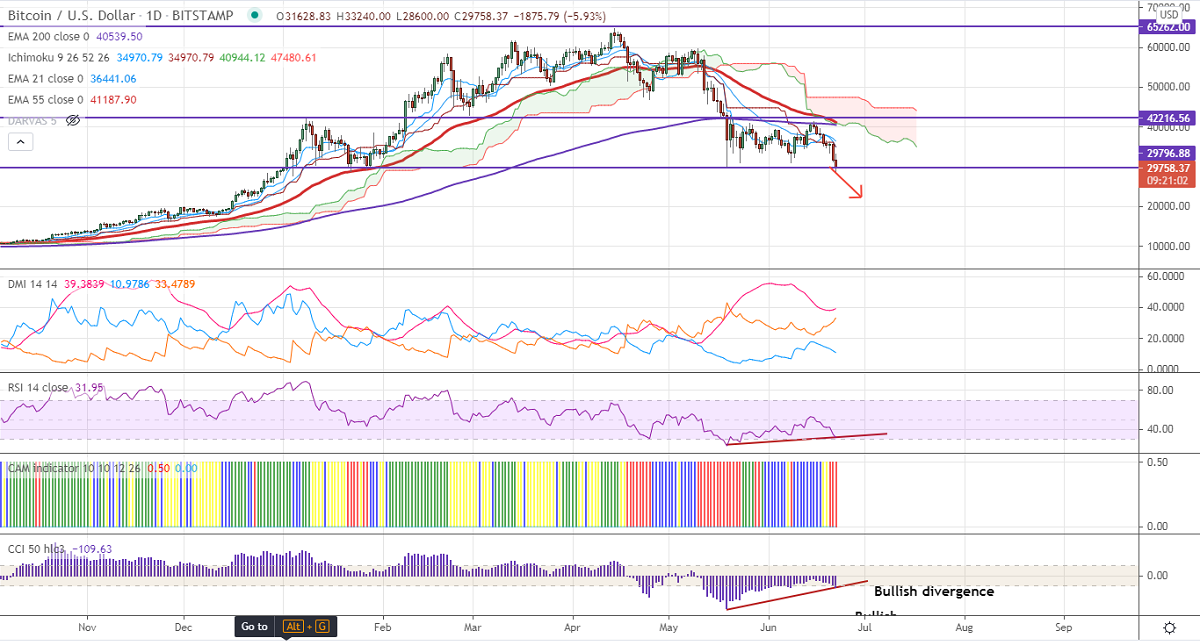

Chart pattern- Bullish divergence (RSI and CCI (50))

Ichimoku analysis (Daily chart)

Tenken-Sen- $36290

Kijun-Sen- $36185

BTCUSD breaks major support $30000 low made on May 19th, 2021 despite micro strategy acquired additional 13005 Bitcoin. The People's Bank of China (PBOC) said that banks must block crypto transactions. The pair has lost more than 15% after a minor pullback to $33240.The short-term trend is still bearish as long as resistance $43000 holds. It hits an intraday low of $28600 and is currently trading around $29050.

The near-term resistance is around $31586. Any indicative break above targets $33458/$35530/$36485/$38725.Minor bullish continuation above $41500.

The pair's minor support is around $28500. Any convincing break below will drag the pair down to $26800/$24651 (161.8% fib)/$22450.

Indicator (Daily chart)

CAM Indicator – Bearish

Directional movement index – Bearish

It is good to buy on dips around $28500 with SL around $25000 for TP of $41300.