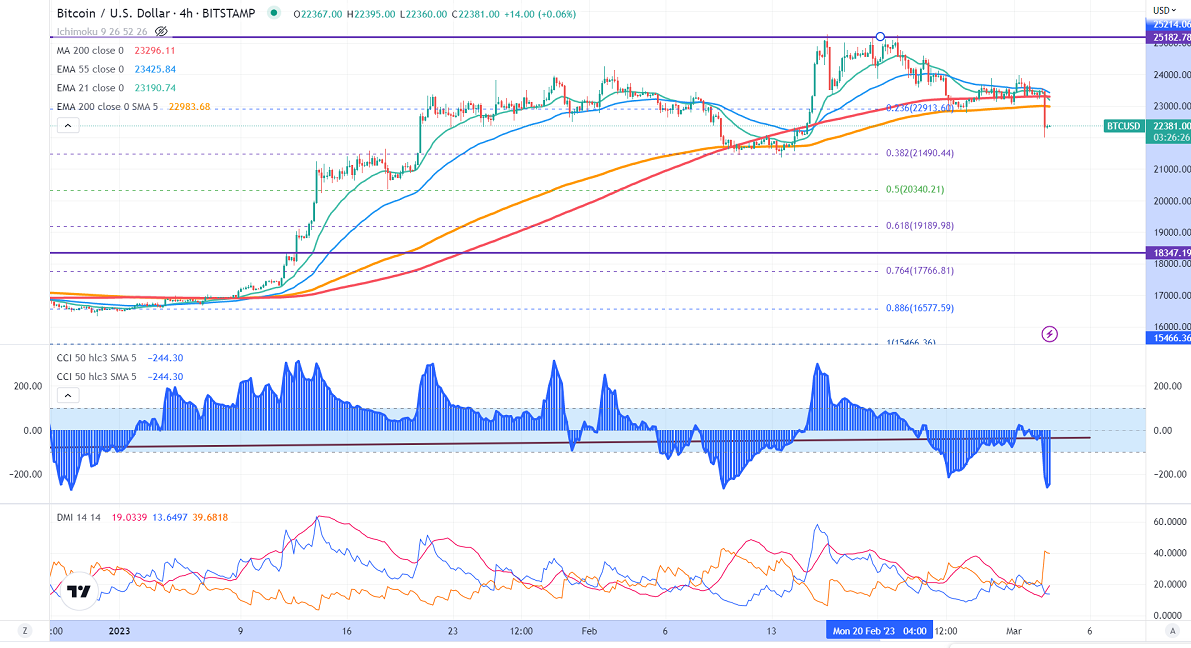

BTCUSD showed a minor sell-off after news about Silvergate. The Crypto friendly bank Silvergate shook out bullish leverage from the futures market. According to the glass node data, exchanges have liquidated longs position worth $62 million, the highest since Aug 2022. The upbeat US economic data also puts pressure on crypto markets at higher levels. estimates.BTC hits an intraday low of $22000 and currently trading around $22378.

Factors to watch for Bitcoin price action-

US markets -

NASDAQ (positive correlation with BTC)- Bearish (negative for BTC). The index pared most of its gains after a minor jump to 12906. Any close below 11800 will push NASDAQ prices lower to 11335/11000.

The US 10-year yield holds above 4%, the highest level since Nov hopes of an aggressive rate hike by the Fed. The US 10 and 2-year spread widened to -83.8 basis points from -77% bpbs.

Technicals-

Major support- $21490. Any break below will take to the next level at $20300/19000 if possible.

Bull case-

Primary supply zone -$23000. The breach above confirms minor bullishness. A jump to the next level of $23990/$25250 is possible. Bearish invalidation only if it breaks $25300.

Secondary barrier- $25300. A close above that barrier targets $30000/$37000/$4000.

It is good to sell on rallies around $23000 with SL around $24000 for TP of $19000.