Although NZDJPY shows interim rallies, these upswings seem to be momentary as the overbought pressures signal weakness. The decline in January could extend below 70.00 if the coronavirus epidemic persists. Event risk during the next week comes from wage data and a leading index.

Hence, it is wise to capitalize on interim rallies and optimize ‘debit put spreads’ ahead of RBNZ’s monetary policy that is scheduled for the next week. The kiwis central bank cut 50 bps in its August meeting and had said that there was room to cut further "if required." We interpret this as an easing bias rather than a signal. In other words, the RBNZ views a cut as more likely than a hike, but is not committing to either at this point. We reckon that the prevailing rallies of NZDJPY are momentary, NZD is expected to depreciate towards 67 levels by year-end.

Before we deep dive into the hedging framework, let’s just quickly glance at the bullish and bearish driving forces of NZDJPY.

Bearish NZDJPY scenarios:

1) Tightening by banks forces a deeper slowdown in credit growth, and weakens the agricultural sector;

2) The immigration rolls over more quickly.

3) The global investors’ risk aversion heightens significantly;

4) Global economy enters serious recession; and middle-east tensions escalate sharply.

5) The decline in January could extend below 70.00 if the coronavirus epidemic persists as China has been Kiwis' major trade partner.

Bullish NZDJPY scenarios:

1) NZ fiscal easing is accelerated;

2) NZ housing lifts more meaningfully thanks to a winding back of LVR restrictions.

3) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens further.

OTC Updates, Trade and Hedging Recommendations:

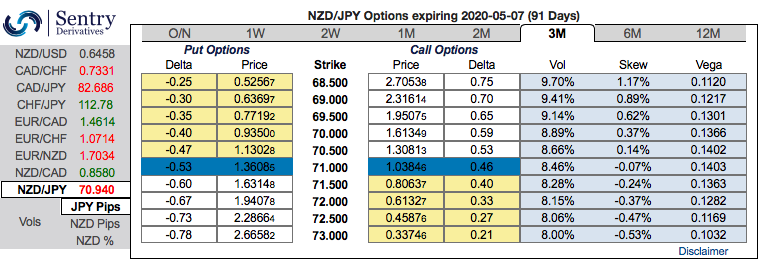

3m IV skews are right indications for NZDJPY that have still been indicating bearish risks. The major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

The positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 68.50 levels (refer above nutshells evidencing IV skews).

Hence, initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit (spot reference: 70.957 levels).

Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce cost of hedging with time decay advantage on short leg, while delta longs likely to arrest potential bearish risks.

Alternatively, shorts in the mid-month futures have been advocated with a view of arresting further downside risks. Courtesy: Sentry

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data