Bearish USDJPY scenarios, see 104 if:

1) The trade tensions between the US and China/Mexico intensify and global investors’ risk aversion heightens significantly,

2) The markets further price in a possibility of Fed’s rate cut and 3) the US starts vehemently criticizing Japan’s trade surplus against the US.

Bullish USDJPY scenarios, see 115 if:

1) The outlook of the US and global economies recovers and risk sentiments firm along with a spike in UST yields,

2) The momentum in JPY selling flows related to outward portfolio investments and FDI strengthens.

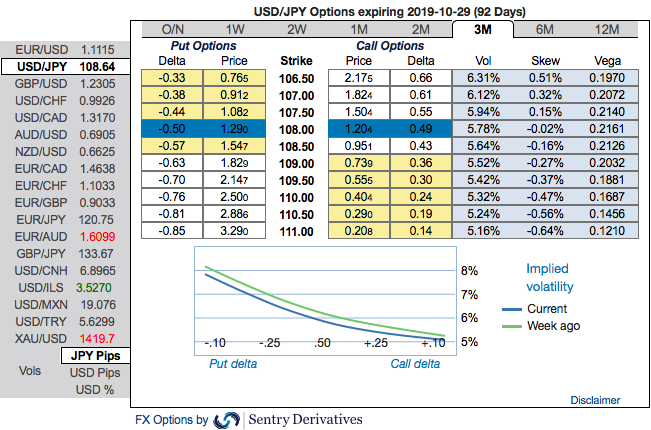

USDJPY OTC update and options strategy as follows:

Please be noted that the positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 106.50 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand.

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run.

OTC positions of noteworthy size in the forex options market can stimulate the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

Hence, at spot reference of USDJPY: 108.64 levels, we advocate buying a 2M/2w 109.732/106.50 put spread ahead of Fed and BoJ monetary policies (vols 6.61 vs 6,89 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. The lower/shrinking implied volatility is good for options writer and increasing realized volatility is good for the bearish trend. Hence, the above strategy seems to be the best suitable in prevailing volatile conditions. Courtesy: JPM, Sentry & Saxo

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand