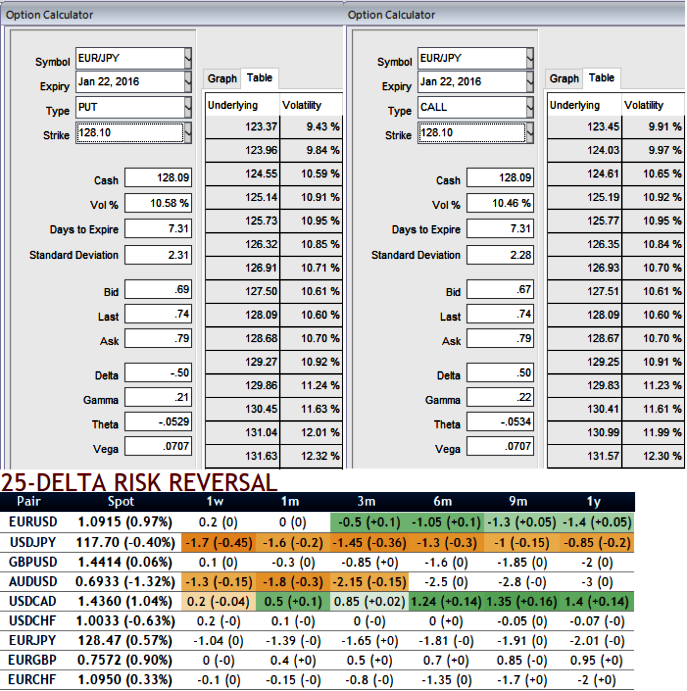

The gradual increase in negative delta risk reversal numbers signify how the FX downside risk management taking place as OTM puts make OTC markets sentiments intensified even though these instruments seem to be expensive to mitigate the potential downside risks in a long run.

While IVs also gradually increasing would mean that EUR/JPY's downtrend is intact in long run. But OTC volume index has not shown convergence with this indication.

These negative risk reversal is moving in tandem with rising implied volatilities which is quite reasonable as the volumes must also have been increased. It has been edging higher in case of EURJPY from 10.4% (1M) to 10.8% (1Y).

Our recent observation on the IV factor of ATM contracts with 1w expiry of Yen denominated currency crosses tops the list and same is the case with risk reversal table for highest hedging activities eyeing downside risks.

As we can very well understand the hedging activities of downside risks are mounting up, as a result ATM Put options seem costlier. Volatility smiles most frequently tells that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

Hence, with the current spot FX is trading at 128.09, the recommendation is to use higher vols to short ITM puts and add an extra-long on put with 1M expiry in the strategy.

For fresh short build up positions, gazing at short term upswings short 1 lot of 3D (0.5%) ITM puts with positive theta values, simultaneously go long in 2 lots of 1M ATM -0.49 delta put and (use shorter expiries on short side as stated in the strategy).

Alternatively, the risk averse can even deploy option strips as well but idea is to capitalize on likely short term upswings for shorts on puts so as to enter the trade with least cost comparatively to option strips.

With these narrow strike differences, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement.

FxWirePro: Bears capitalize on risk reversals in Yen denominated pairs – gear up with vega ITM shorts in PRBS to hedge EUR/JPY bearish risks

Friday, January 15, 2016 7:52 AM UTC

Editor's Picks

- Market Data

Most Popular