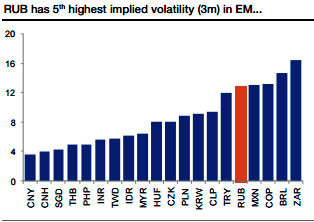

Please be noted that the IVs of RUB are the highest among G20 currency space. The volatility parameters favor structures that sell topside skew to cheapen up bullish USDRUB exposure. Being long USDRUB is a good hedge for a portfolio with high yielder exposure.

Are you concerned that RUB positioning is too heavy? We are. The stagnant price action is a warning sign, fundamentals could turn, and a significant correction could happen? On 31 May, we recommended going long USDRUB as the ruble had approached the tipping point, looking for a move to 61.30 in the next three months, based on domestic factors. We have a constructive view on EM assets, and our portfolio of trade recommendations is long FX carry trades (ZAR, MXN and TRY).

However, our exposure has been selective, and we have shied away from short dollar risk in the BRL and RUB in recent months. Being long USDRUB is a good hedge for a portfolio with high yielder exposure.

Negative carry is quite punitive in forwards (-75bp/month), so cost-effective option exposure is a good alternative. Shorting the RUB in volatility space is also very expensive: implied vol is one of the highest in EM and risk reversals are the highest. The skew-to-ATM volatility ratio has been rising steadily since early 2016, likely related to investors hedging bullish RUB price action. These volatility parameters favor structures that sell topside skew to cheapen up bullish USDRUB exposure.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise