EURUSD prices are back under pressure, having failed to break-out stiff resistance at around 1.1450 - 1.1500 areas. We are now developing into a bear channel, with 1.1385 resistance and 1.1280/70 the next support - that ahead of the 1.1215 recent lows.

On medium-term perspective, we view 1.12 - 1.08 as a major support region and the ideal area for a long-term higher low over the 1.0340 lows set in 2016. Notable supports within this region lie at 1.1190 and 1.1000. We need further evidence that 1.1215 was the higher low we are looking for.

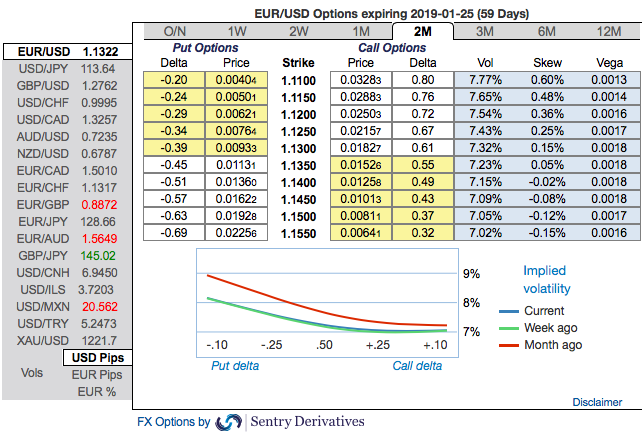

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 2m tenors signify the hedging interest of bearish risks.While the negative risk reversals of 1-3m tenors indicates bearish risks remain intact in the major trend.

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

It’s a quiet calendar today for data releases. Most market interest will probably be on the US Federal Reserve Vice Chairman Richard Clarida at 13:30 GMT, who is a keynote speaker at a New York conference. At the same conference, the Fed’s Esther George, Raphael Bostic and Charles Evans will also speak on a panel at 19:30GMT. Principal interest, however, will be reserved for Fed Chairman Jerome Powell’s speech tomorrow.

The US Conference Board’s consumer confidence report will also be released later today. We expect the headline index to fall to 136.0 in November from 137.9, which would be the first decline since June, perhaps reflecting rising interest rates and falling equity prices. Nevertheless, confidence would still be at historically strong levels, supported in part by a strong labour market.

US 10-year Treasury yields are steady at 3.05% ahead of key Fed speakers today and tomorrow. Markets are looking for clarification of monetary policy beyond the expected increase to 2.5% in December.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 2M tenors, go long 1m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Currency Strength Index: FxWirePro's hourly EUR spot index is showing -61 (which is bearish), while USD is flashing at 107 (which is bullish), while articulating at (09:42 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One