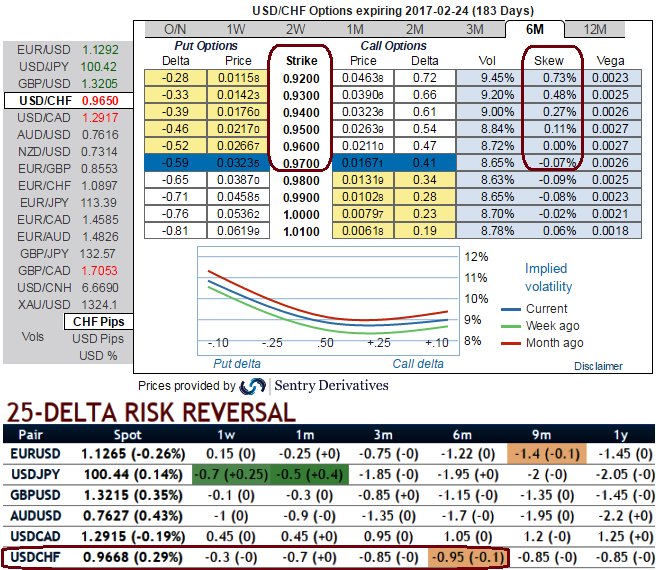

ATM implied volatilities are gradually creeping up, rising 8.61% in 1m tenor to 8.88% in 6m.

The 6M IV skews signify the importance of OTM put strikes in OTC markets for this pair.

While, risk reversals of 6m tenors have also been moving in sync with IVs and spot FX movements.

Whereas, we see no significant changes in 1m bearish hedging sentiments in OTC FX market of this pair as these numbers also have been bearish-neutral for next 1-3 months or so. Accordingly, we reckon it would be wise to capitalize on these indications to hedge downside risks

25-delta risk reversals evidence no disparity in volatility and prices, between puts and calls on the most liquid out of the money (OTM) options quoted on the OTC market.

A positive change in risk reversal would mean that the vols of OTM call is greater than that of the vols of similar puts, which implies that more market participants are betting on a rise in the price of the underlying security than on a drop, and vice versa if the risk reversal is negative.

Contemplating above IVs and risk reversals, we USDCHF continues to slide but certainly shows spikes in between, as a result we could foresee some sort of either sloping or range bounded trading opportunities in the prevailing range of 0.9825 and 0.9519 levels in next 1-3 months or so.

So those who believe it can still be possible to pull out returns by holding options from this oscillating scene from this pair while IVs are creeping up gradually, even though exhausted bulls who think long lasting non-stop streak of Bear Run to take halt at this point amid abrupt upswings periodically, then hedgers can optimally hold long puts in 6m contracts while eyeing on 1m put writings.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX