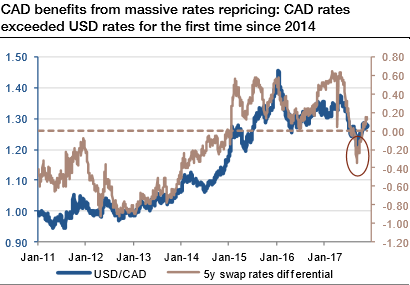

In loony’s fair assessment, the monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (refer above graph), and our USD rates projections can realistically drag the USDCAD to 1.20.

The Bank of Canada (BoC) has become more cautious again after CAD appreciated heavily following two rate hikes. In view of numerous risks (inflation, oil price, NAFTA) the BoC does not want to be overly optimistic.

We assume that for the time being the BoC will initially follow the Fed’s rate hike speed so as to prevent strong CAD appreciation against USD. The better growth outlook in Canada, as well as the more stable political environment, will, however, allow gradual CAD appreciation in the future.

Notably, please be informed that the CAD implied vols are on lower side among G7 FX space, given the low-yielding / funding currency status of both USD and JPY, and CAD’s traditionally tight link to the global growth cycle that tends to exert similar directional influence on both pairs, above-average correlation is the norm rather than the exception for CADUSD and CADJPY; the above chart shows that a hypothetical strategy of systematically owning CADUSD vs CADJPY correlation swaps would have generated high Sharpe Ratio returns (excluding transaction costs, hence hypothetical) over a long history spanning multiple volatility cycles.

A transaction-cost friendly version of the full correlation triangle is to buy CADJPY – USDJPY vol spreads that are historically low (6M ATM spread 0.9 vs. 3-yr avg. 1.6), offers marginal (0.5 vol pts.)

Thus, we wish to offload the put side of options strips strategy that was advocated a fortnight ago and prefer 3m USDCAD +0.51 delta ATM call. While CADJPY seems to be like a straddle containing ATM puts as well as calls of 2m tenors.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 61 levels (bullish), while hourly JPY spot index was inching higher towards -39 (bearish) and USD at -136 (bearish) while articulating (at 07:17 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise